Coin Metrics’ 2025 Crypto Outlook

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead

Coin Metrics’ 2025 Outlook Report

By: Tanay Ved, Cooper Duschang and The Coin Metrics Team

Introduction

2024 was a monumental year for the digital assets industry, beginning with the long-anticipated approval of spot Bitcoin ETFs and culminating in the U.S. presidential elections. Institutional capital entered the market, propelling Bitcoin to new highs and with it, lifted the entire ecosystem. Stablecoins surged past $200B, tokenization of RWAs gained momentum, and corporate demand for Bitcoin accelerated at an unprecedented pace. Bitcoin underwent its quadrennial halving, Ethereum scaled with blobs, and Solana’s ecosystem ballooned. Meanwhile, old narratives faded, making way for emerging themes.

Not long ago, the crypto industry faced intense SEC scrutiny and a challenging rate-hike cycle clouded by uncertainty. Now, optimism has returned. Bitcoin surged past $100K post-election, supported by a pro-crypto U.S. administration and renewed enthusiasm across the ecosystem. These developments leave the industry on a strong footing as we turn toward 2025, ready to explore the transformative trends and opportunities that lie ahead.

Market Outlook

Assets, Themes & Sectors

Outlook: In 2025 we expect selective outperformance spanning new and established categories, such as Layer-1 blockchains, decentralized finance (DeFi) on Ethereum, Solana, and Base, and the evolving intersection of Crypto and AI.

Source: Coin Metrics Reference Rates

Bitcoin (BTC)

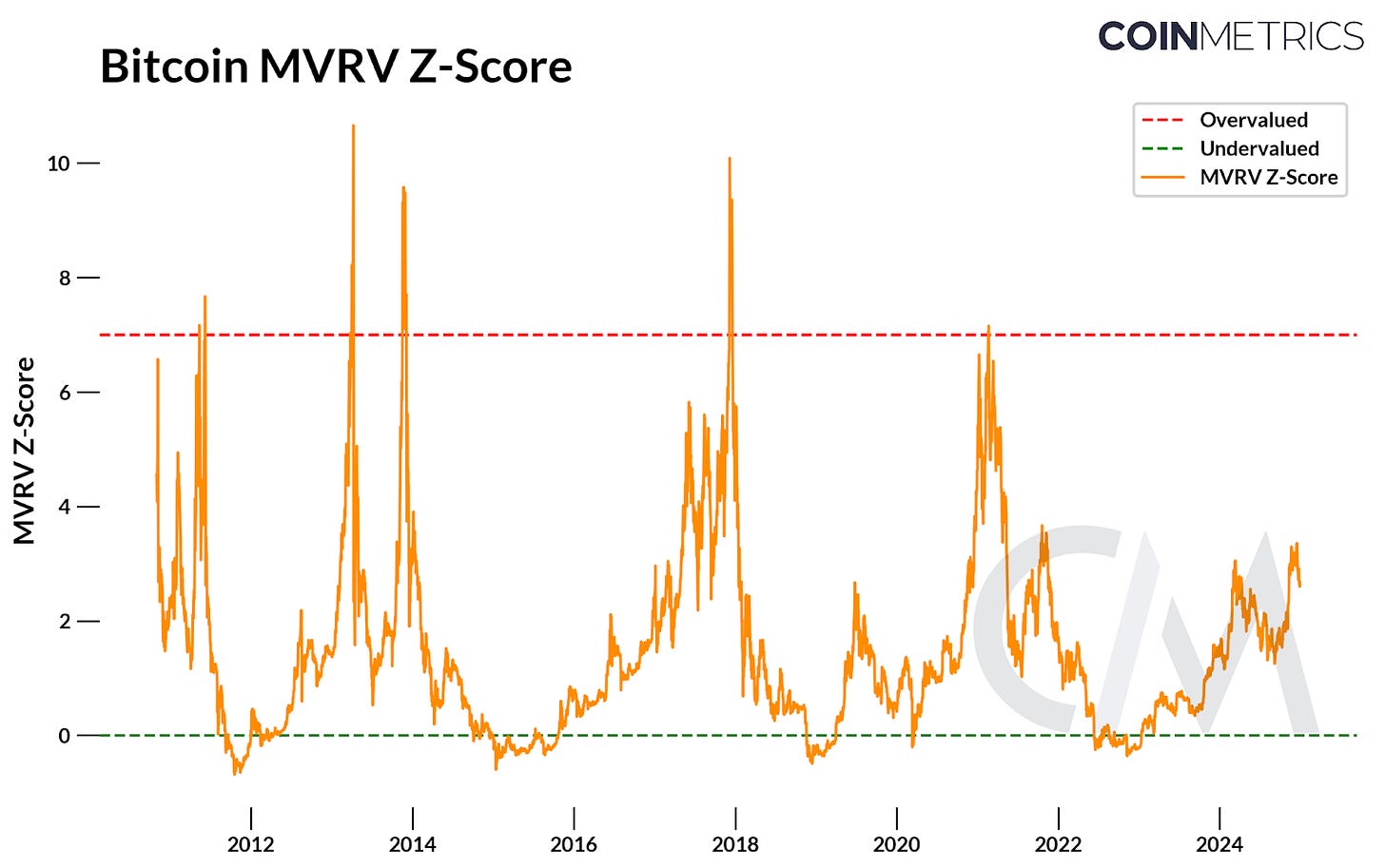

Outlook: Bitcoin (BTC) will test a price range of $140K–$170K in 2025, supported by cyclical growth trends and accelerating structural adoption. Sustained flows into ETFs, corporate treasury adoption and potentially nation state adoption will drive demand for BTC against a backdrop of reduced supply.

Source: Coin Metrics Network Data Pro

Ethereum (ETH)

Outlook: Ethereum’s underperformance will dissipate as the ETH/BTC ratio reverses to 0.055. We anticipate Ethereum (ETH) to reach a price range of $7,500–$10,000, driven by increasing institutional demand, the maturation of the Layer-2 ecosystem, and Ethereum's sustained dominance in stablecoins, RWA tokenization, and DeFi.

Source: Coin Metrics Reference Rates

Airdrop Trends

Outlook: While airdrops could continue to disappoint speculators in 2025, new iterations of airdrops and adjusted distribution structures and processes could create more satisfied users rewarded for their participation.

Industry

Exchange Traded Funds (ETFs)

Outlook: As the regulatory environment eases under a new administration, bringing more clarity to the digital asset space, we anticipate broader institutional participation to sustain significant inflows into U.S. spot Bitcoin ETFs. Assets under management (AUM) are expected to more than double, with Bitcoin holdings surpassing 2.5 million BTC in 2025.

Source: Coin Metrics Labs

Infrastructure

Layer-1’s

2025 Outlook: The Layer-1 technical landscape is set to evolve beyond the EVM, with demand for blockspace consolidating around the EVM, Ethereum, and Solana ecosystems, driven by continuous advancements in base layer and scaling solutions. The “Layer-1 premium” will remain strong.

Source: Coin Metrics Network Data Pro

Layer-2’s

Outlook: Blob space will play an increasingly critical role in Ethereum scalability. With more institutional (Ink Chain, Soneium) and custom (Unichain) Layer-2s built to settle on Ethereum, blob fees are expected to account for a greater percentage of total fees paid on Ethereum.

With plans to increase the target blob rate in Ethereum’s Pectra upgrade, Layer-2s will need to continue monitoring their blob inclusion while ensuring fees are minimized versus alternative data availability solutions.

Source: Coin Metrics Network Data Pro

Applications

Stablecoins

Outlook #1: Stablecoins grew by ~50% in 2024 to over $200B and settled over $12T in total transfer volume. We expect stablecoin supply to cross $400B and settlement volumes to grow over $20T in 2025, driven by the bull market, entrance and expansion of issuers across networks, passing of stablecoin legislation and adoption for consumer and enterprise payments & financial services.

Source: Coin Metrics Network Data Pro

Outlook #2: USDT and USDC will likely maintain their positions as the top two stablecoins in 2025, exceeding their 2024 growth rates and sustaining market dominance. However, “Other” stablecoins—propelled by new launches and the growth of existing alternatives—are expected to narrow the gap in total supply and capture an increasing (~30%) share of the stablecoin market.

Source: Coin Metrics Network Data Pro

Real World Asset (RWA) Tokenization

Outlook: We expect an influx in tokenized assets across leading chains as the regulatory landscape evolves and institutions search for more easily-accessible capital and liquidity rails. As a result, the RWA market will double in assets brought onto public blockchain rails. We predict at least one publicly traded company on the NYSE or NASDAQ will tokenize their shares on the blockchain.

Source: Coin Metrics RWA Tokenization Report

Conclusion

While there is plenty of positive momentum coming into 2025, it's important to acknowledge certain macroeconomic and crypto-specific risk factors that remain. Inflation, although in a better state than before, remains sticky and a slowdown in earnings for “magnificent seven” could have ripple effects for the crypto industry. Failure for pro-crypto regulations to take shape as per expectations and idiosyncratic factors like a reversal MicroStrategy’s bitcoin accumulation strategy could pose headwinds for 2025. Therefore, we remain cautiously optimistic for the year ahead.

For a deeper dive into the trends and outlooks shaping the crypto industry in the year ahead, be sure to check out our 2025 Outlook Report below:

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.