Pectra: Ethereum’s Next Major Upgrade

Breaking down key changes included in Ethereum's Pectra hard-fork

Get the best data-driven crypto insights and analysis every week:

Pectra: Ethereum’s Next Major Upgrade

By: Tanay Ved

Key Takeaways:

Pectra, Ethereum’s next major upgrade, introduces changes to both the Execution Layer (Prague) and the Consensus Layer (Electra). It is set to go live on testnets in February and March, with mainnet activation expected in April.

The upgrade introduces key improvements to staking, Layer-2 scalability and user experience (UX), setting the foundation for future changes.

Key changes include higher validator stake limits, flexible staking withdrawals, enhancements in account abstraction and increased blob throughput, contributing to network efficiency and security.

Introduction

Nearly 29 months after “The Merge”, 22 months after “Shapella” and 11 months after “Dencun”, we approach Ethereum’s next major upgrade—the Pectra hard-fork. As the largest proof-of-stake (PoS) blockchain, securing ~$90B in ETH staked, over $135B in stablecoins, and ~$4B in tokenized assets, Ethereum continues to evolve through incremental upgrades.

Pectra is set to be the largest hard-fork in Ethereum’s history in terms of the number of Ethereum Improvement Proposals (EIPs) planned for inclusion. Building on the foundation of last year’s Dencun upgrade, Pectra introduces features to improve user experience (UX), validator operations and support further scaling of Layer-2’s, suggesting its widespread impact to Ethereum stakeholders. In this week's issue of Coin Metrics’ State of the Network, we break down Pectra’s key changes and what they mean for users, stakeholders, and investors ahead of its expected mainnet activation in April.

What is Pectra and Why Does it Matter?

Like previous Ethereum upgrades, Pectra introduces changes to both the Execution Layer (EL) and Consensus Layer (CL). Its name reflects this dual focus: 'Prague,' named after the host city of Devcon 4, represents the execution layer upgrade, while 'Electra,' a star in the Lyra constellation, signifies the consensus layer upgrade.

Pectra was envisioned as an ambitious upgrade, initially planning to include up to 20 Ethereum Improvement Proposals (EIPs). However, as development progressed, it was split into two phases to better refine and manage its complexity. Now in its final stages, Pectra is set to launch on Ethereum testnets in February and March, followed by mainnet activation in early April.

Before we dive into individual EIPs, it's important to understand the overarching areas Pectra aims to address, which we will bundle into, staking & validator dynamics, user experience (UX) and L2 scaling.

Validator and Staking Improvements

There are three major EIPs that seek to improve the experience tied to validator operations in Ethereum’s proof of stake (PoS) system:

EIP-7251: Increase the Max Effective Balance

Ethereum’s current staking design limits a validator’s effective balance to 32 ETH, meaning solo stakers must stake in fixed increments of 32 ETH, which is the maximum a single validator can stake. Any rewards earned beyond this limit do not contribute to their active stake. EIP-7251 raises this maximum effective balance (MaxEB)to 2048 ETH, meaning that a single validator can now stake between 32 and 2048 ETH. This is expected to:

Improve staking flexibility: Stakers can now compound rewards over their entire balance rather than being restricted to multiples of 32 ETH. For example, a validator with 33 ETH will have all 33 ETH counted toward rewards, improving capital efficiency and flexibility in staking operations.

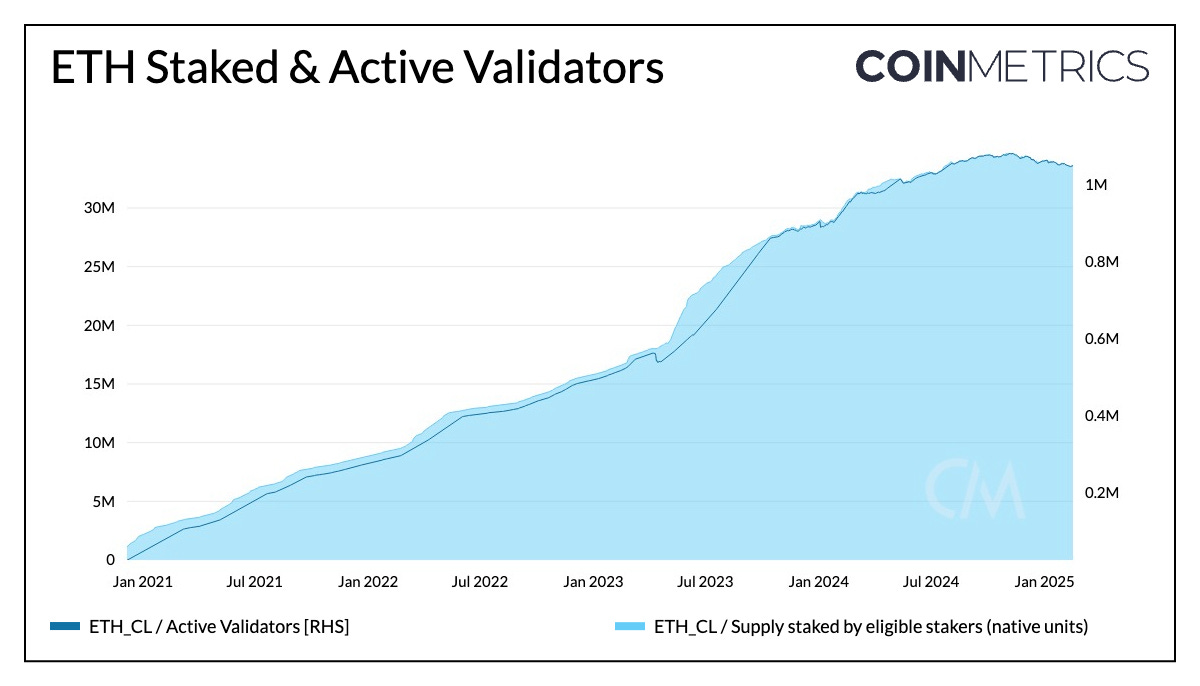

Lower validator count: Ethereum currently has 1.05M active validators on the consensus layer. This EIP will allow larger operators to consolidate their validators, which is expected to lower validator count and alleviate network overhead from a large validator set.

Reduce network load: While a high validator count strengthens decentralization, it also increases bandwidth and computational demands. Raising the MaxEB enables a more efficient validator set, reducing peer-to-peer communication overhead.

Source: Coin Metrics Network Data Pro

EIP-7002: Execution Layer Triggerable Withdrawals

This EIP expands validator capabilities and complements the EIP above. EIP-7002 enables validators to initiate exits and partial withdrawals directly through their execution layer (0x01) withdrawal credentials. Validators have two keys: the active key for performing validator duties and a withdrawal key for accessing and managing staked funds. Previously, only the first key could trigger an exit. Now, withdrawal credential addresses can also initiate exits, allowing for larger withdrawals and reducing reliance on node operators. This change enhances validator control over funds and enables fully trustless staking pools, improving security and decentralization.

EIP-6110: Supply Validator Deposits On Chain

EIP-6110 streamlines validator onboarding by improving how deposits are processed between Ethereum’s Execution Layer (EL) and Consensus Layer (CL). Currently, when a new validator deposits on the execution layer (EL), it must wait for the consensus layer (CL) to recognize and process it before activation, leading to delays. EIP-6110 allows the EL to directly communicate validator deposits to the CL, removing the need for an additional verification process and reducing the activation delay from around ~9 hours to ~13 minutes.

Scaling Blobs and Layer-2s

EIP-7691: Blob Throughput Increase

Beyond validator improvements, Pectra also brings key changes to Ethereum’s data availability and scaling. The Dencun upgrade last year introduced blobs as a new efficient way of storing data from Layer-2 rollups. Blobs are now widely adopted across Ethereum L2s, with an average of 21,000 blobs posted daily. However, blob usage has consistently hit capacity, increasing fees and limiting throughput.

Source: Coin Metrics Network Data Pro, Blob Metrics

The network currently targets an average of 3 blobs per block and a maximum of 6. EIP-7691 will increase the target to 6 and maximum to 9, growing the capacity for storing data and therefore increasing throughput and scalability. Data storage costs will reduce, resulting in cheaper blob fees for Ethereum L2s and thus transaction fees for end users.

EIP-7623: Increase calldata cost, is another EIP that complements blob adoption. Before the introduction of blobs, L2s used calldata to store data on Ethereum, which they still use from time to time as it can be more cost-effective. By raising costs for calldata, this change can incentivize L2s to exclusively utilize blobspace, making rollup transactions even more efficient.

User Experience (UX) Enhancements

EIP-7702: Set EOA Account Code

EIP-7702 is a largely anticipated change as it brings Ethereum closer towards account abstraction. It is expected to vastly improve user experience (UX) and wallet functionality by allowing externally owned accounts (EOAs), or user wallets, to temporarily function as smart contract wallets. This enables them to execute logic similar to smart contracts, providing greater flexibility for users, and programmability for wallets and apps.

After Pectra, users and developers can leverage EIP-7702 to:

Bundle transactions: batch multiple transactions or user operations into a single transaction. (e.g., approving and swapping tokens in a single transaction).

Transact without gas: allowing account X to pay for a transaction on behalf of account Y, or “paymaster contracts” to cover gas fees for users.

Conditional or sponsored transactions: Implement spending controls, automated actions, or sponsored transactions based on set conditions.

While we covered the most impactful changes in Pectra, several other EIPs also contribute to network improvements. These include EIP-2513, EIP-2935, EIP-7549, EIP-7865, and EIP-7840, all focused on optimizing efficiency and reducing resource consumption across the network.

Conclusion

Yet again, Ethereum is preparing for a major upgrade—this time with a record number of EIPs. Pectra aims to enhance Ethereum’s most pressing priorities, including the transition toward account abstraction, improved validator operations, greater network efficiency, and incremental scaling of Layer-2 blob utilization. At the same time, as Vitalik Buterin highlighted in a recent blog post, Ethereum continues to scale Layer-1 despite its rollup-centric roadmap. With the recent gas limit increase to 36 million, further expansions are expected to boost censorship resistance, throughput, and scalability.

While Pectra’s changes are primarily technical, many may wonder how they could impact ETH’s valuation. Historically, ETH has seen measurable shifts in price around prior upgrades, but market sentiment—both within crypto and in broader financial markets—often plays a larger role than direct changes to Ethereum’s economics. Nevertheless, Pectra is poised to advance Ethereum’s adoption, and as we move beyond this upgrade, we will revisit its impact on key network metrics, ecosystem stakeholders, and ETH as an asset.

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

Bitcoin active addresses decreased by 4%, while Ethereum and Solana active addresses rose by 6% over the past week. USDC on Ethereum saw its market cap grow by 2.7% to 37B, while PayPal USD on Ethereum grew by 15% in market capitalization to a record 498M.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.