Get the best data-driven crypto insights and analysis every week:

Weekly Research Focus

Crypto’s Biggest Storylines Going Into 2021

By Nate Maddrey and the Coin Metrics Team

The end of 2020 saw crypto climb to new highs. In this issue of State of the Network we look ahead to 2021 and preview some of crypto’s biggest storylines going into the new year.

Bitcoin’s Institutional Rise

Over the course of 2020 institutions began to embrace bitcoin like never before. In May, a few months after a market wide crash in March, billionaire investor Paul Tudor Jones publicly endorsed bitcoin as a potential hedge against inflation. By Q4 2020 dozens of other institutions had joined in.

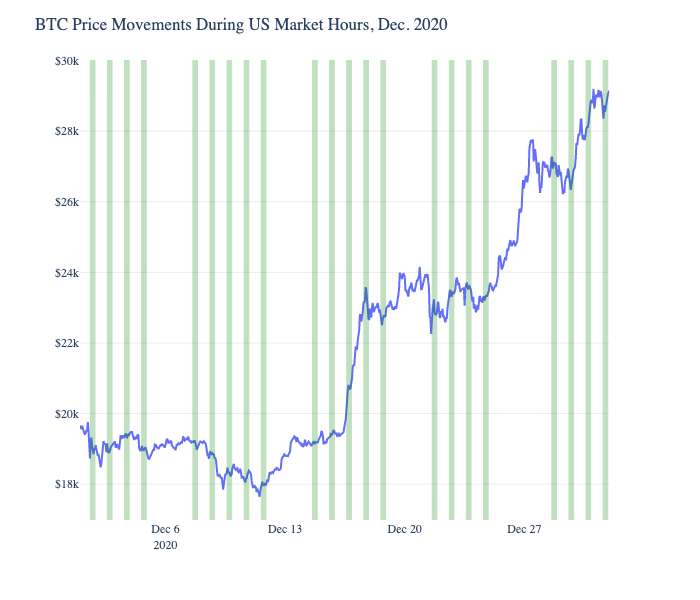

In a sign of increased US institutional adoption, bitcoin’s price rises occurred mostly during US market hours during November 2020. This pattern somewhat changed towards the end of the year - the below chart shows bitcoin’s price movements during market hours in December 2020, with US hours highlighted in green. While a large price jump on December 16th occurred during US market hours the biggest movement of the month happened over Christmas and the following weekend while markets were closed.

However, this may have been caused by large holders who took advantage of the relatively low liquidity over Christmas to push the markets in their desired direction. We saw a similar pattern during Thanksgiving when US markets were also closed. Other than the Christmas holiday, price movements have continued to occur largely during US hours.

Source: Coin Metrics Reference Rates

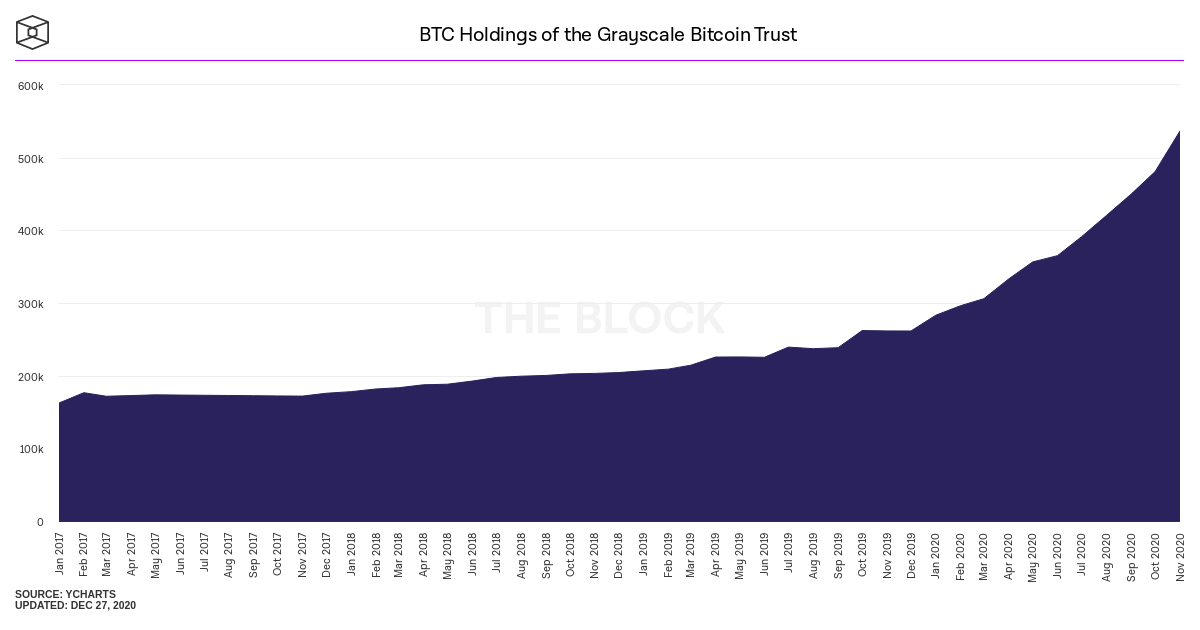

In another sign of increased institutional adoption, the amount of BTC held by the Grayscale Bitcoin Trust skyrocketed to close out the year. The Grayscale Trust is currently one of the major ways for traditional institutions to get exposure to bitcoin so is often considered a good way of tracking institutional interest. Similarly, CME Bitcoin Futures open interest hit new all-time highs to close the year. CME is a regulated exchange which makes it a more attractive investment option for institutions compared to most other crypto futures offerings.

One of the big questions for 2021 is whether this institutional interest will continue to accelerate, or whether it will plateau or decline at some point over the year. Early signs appear to point to an acceleration, at least for now. On January 4th, Three Arrows Capital disclosed a $1B position in the Grayscale Bitcoin Trust. On the same day SkyBridge Capital also announced a $300M bitcoin position and the launch of a new bitcoin fund for accredited investors.

Another big story going into the new year is the impending Coinbase IPO. As one of the largest crypto exchanges in the world Coinbase has already attracted the attention of traditional, institutional investors. If it successfully IPOs many new investors will likely be drawn to the industry, which would only increase institutional interest. Early signs suggest that 2021 could be another big year for institutional interest in bitcoin.

Ethereum’s Next Chapter

Ethereum is already off to a hot start in 2021 with price jumping from $730 on January 1st to $990 by January 3rd. With many exciting upcoming developments over the next year ETH is also well positioned to benefit from the growing institutional interest in crypto.

Source: Coin Metrics Network Data Charts

On December 1st the first phase of Ethereum 2.0 was successfully launched. It will be many years before Ethereum is able to fully move to Proof of Stake, but momentum around the transition is already growing. The Ethereum 2.0 staking deposit contract has over $2 billion locked at time of writing.

Additionally, in late November, Coinbase announced that they would start supporting Ethereum 2.0 staking in early 2021. With the potential to earn passive yields through Ethereum’s new staking system institutions will be increasingly incentivized to start investing in ETH.

In more evidence of ETH’s growing maturation, CME Group announced its plan to introduce ETH futures by February, 2021. Building on the success of CME Bitcoin Futures, ETH Futures will be a trusted way for institutional investors to gain exposure to ETH derivatives.

Ethereum activity increased dramatically during 2020. The rapid rise of DeFi over the summer and surge in NFT activity towards the end of the year have pushed Ethereum to new heights, as well as new limits.

Source: Coin Metrics Network Data Charts

As a result, ETH transaction fees soared to new heights throughout the second half of 2020. But a new protocol improvement may help address that issue, as well as help make Ethereum’s monetary policy more attractive to investors. EIP-1559 has been proposed as a way to fix Ethereum’s inefficient fee market. Additionally, it suggests burning a portion of ETH transaction fees, which would effectively decrease ETH inflation. If EIP-1559 is successfully implemented in 2021 Ethereum could be next in line to undergo a wave of institutional investment.

Looming Regulation

Despite the many positive developments going into 2021 some potential dark clouds loom. As crypto prices surged, the amount of regulatory attention on the industry increased as well.

2020 saw the arrests of the BitMEX executive team, as well as regulatory crackdowns on several other large exchanges. In December, the STABLE Act was introduced as a way to regulate stablecoins with potentially far reaching consequences for the rest of the crypto industry. At the end of the year the SEC filed a lawsuit against Ripple Labs Inc. alleging that XRP had been sold as an unregistered security. And FinCEN announced the intention to require US citizens to disclose offshore crypto holdings, in addition to increased rules around exchange KYC reporting.

Crypto regulation is nothing new, as regulators have targeted various parts of the industry for years. But with more and more eyeballs on the industry regulation is likely to continue to pick up going into 2021. While there may be some pain in the short-term, increased regulation should hopefully be a good thing for crypto in the long run. The crypto industry is more organized and motivated than ever before to help fight back against regulation that is deemed to be harmful or too overbearing. Regulatory clarity will not only help institutions feel more at ease, but should also help drive out some of crypto’s bad actors and help the cream rise to the top.

With all of the changes on the horizon, crypto is poised for another exciting year in 2021.

Network Data Insights

Summary Metrics

BTC, ETH, and the rest of crypto closed out 2020 on a high note. BTC active addresses grew by 9.3% week-over-week to start 2021, averaging over 1.1M per day. Network security continues to look strong as well with hash rate growing by 11.7% and coming close to a new all-time high on December 30th.

ETH transaction fees are also back on the rise, increasing by over 60% and signaling high demand for Ethereum block space. Daily transaction fees reached an average of about $6.8M per day, over twice the amount of BTC daily fees.

Network Highlights

BTC active addresses are near all-time highs going into 2021. The below chart shows the 7-day rolling average of BTC active addresses. On January 3rd, the 7-day average reached 1.15M, just shy of the all-time high of 1.18M set in December 2017.

Source: Coin Metrics Network Data Charts

Similarly, ETH daily transaction count is near all-time highs going into the new year. The following chart is the 7-day rolling average of ETH transaction count. It reached 1.20M on January 3rd, just below the 1.24M daily transactions recorded in January 2018.

Source: Coin Metrics Network Data Charts

Meanwhile, the number of addresses holding large amounts of XRP has dropped precipitously since the SEC’s announcement of charges against Ripple. The number of addresses holding at least 1M XRP dropped from 1,721 on December 21st, the day before the announcement, to 1,567 by January 3rd.

Source: Coin Metrics Network Data Charts

Market Data Insights

The new year has brought exciting, and many believe overdue, price action to Ethereum. As of the time that this is being written, ETH has increased roughly 40% in price since this start of the year to $1,033 from a starting value of $741.

Source: Coin Metrics Reference Rates

This move did not come without volatility. Over the course of seven hours between January 3 and 4th, the price increased from roughly $974 to $1,125 and then swiftly fell back down to $945. These rates are based on spot market trading. Across futures things were more volatile with prices as high as $1,186 (Huobi’s ETH-USDT Swap) and as low as $707.37 (Huobi’s ETH-USD Swap).

These swift moves led to over $400m in liquidations on the ETH perpetual futures across exchanges. Below is an aggregation of the liquidations by price level and the total dollar value liquidated. In blues we have “buys” which indicate short sellers forced to cover their positions and in orange we have sells, or margin traders with losses large enough to force them into selling their long position.

Source: Coin Metrics Market Data Feed

Based on this price level analysis, it appears that there was pain for short sellers between $900 and $1,000, and again beyond $1,100. On the way back down levered longs saw more and more liquidations as prices fell. Thankfully buyers stepped in around the $900 level or we likely would have seen a more exaggerated selloff as a greater and greater value of positions was liquidated.

CM Bletchley Indexes (CMBI) Insights

CMBI and Bletchley Indexes had a tremendous start to the new year, all returning above 15% for the week. The CMBI Ethereum was the strongest performer, returning 38.4% to close at $951.23. The CMBI Bitcoin also had a fantastic week, closing up 26.7% at a new all-time high of $33,634.07.

Mid cap (Bletchley 20) and small cap (Bletchley 40) indexes did not perform as strongly but still had impressive weeks, closing up 16.3% and 22.2% respectively. Historically, this pattern of large caps outperforming mid and small caps during a new market bull run is not uncommon. As new dollars enter crypto asset markets, they tend to gravitate to the majors. If this happens with enough volume, like we are experiencing now, the large cap assets can realize significant gains which do not necessarily flow through to the rest of the market in the short to mid term.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here and download the Coin Metrics mobile app here.

Check out the Coin Metrics Blog for more in depth research and analysis.