Coin Metrics' State of the Network: Issue 103

Tuesday, May 18th, 2021

Get the best data-driven crypto insights and analysis every week:

Coin Metrics is hiring! See open positions in Engineering, Research, and more here.

Weekly Research Focus

In Retrospect, It Was Inevitable

By Nate Maddrey and the Coin Metrics Team

After helping push bitcoin (BTC) price to close to $60K just three months ago, Elon Musk sent the markets in the opposite direction this past week with a series of Tweets about crypto.

To kick things off, Musk Tweeted that Tesla had suspended vehicle purchases using BTC due to environmental concerns. From there, he moved on to Dogecoin (DOGE) and suggested that he was working with DOGE devs to make transactions more efficient. He went on to say “Ideally, Doge speeds up block time 10X, increases block size 10X & drops fee 100X.”

Bitcoin energy consumption is a nuanced and complex topic. Although it’s true that Bitcoin mining uses a lot of energy, the energy expenditure is critical for securing the network and keeping BTC safe. While there is still a lot of work to be done to make Bitcoin mining greener, there is a real case that Bitcoin will be a key driver in the future of renewable energy.

Musk and others also often use a transaction-based model for estimating Bitcoin energy usage. In reality this is misguided - miner revenue, which incentives miners to join the network and expend energy, is mostly derived from new BTC issuance and is predominantly a function of price.

Furthermore, blockchain scalability is a notoriously difficult problem. Short-term solutions like increasing transaction throughput also increases the size of the blockchain, which means running a node would require more powerful hardware to keep up with the larger amount of data. This can threaten the network’s decentralization since small, independent node operators end up getting priced out. Increased centralization was one of the main concerns during the Bitcoin block size wars, and has already been endlessly debated within the community. Bitcoin chose to prioritize decentralization and security at the expense of scalability (although scalability should eventually improve thanks to Layer 2 solutions), while other networks have prioritized scalability at the expense of decentralization.

But despite the knee-jerk reaction to Musk’s Tweets, BTC’s recent downturn appears to be part of a larger trend. Crypto markets tend to be cyclical and move from periods of BTC domination to periods where smaller-cap assets reign supreme. Based on the past few months of data, we appear to be in an altcoin cycle where smaller-cap coins outperform. This differs from the start of the year, where BTC led the way amongst most cryptoassets.

Source: Coin Metrics Network Data Charts

A big part of the cycle has been due to ether’s (ETH’s) surge. ETH has outpaced BTC over the last few months as institutional investors appear to have begun to invest in ETH. But as ETH has grown so have “Ethereum competitors,” some of which, like Ethereum Classic (ETC), have effectively come back from the dead. As a result, BTC’s market cap dominance has dropped to about 43%, its lowest level in years.

This is also reflected in trading volumes. Trading volume for smaller-cap assets has surged to new all-time highs over the last few months. Notably DOGE trusted trading volume has rivaled BTC, and ETC briefly rivaled ETH.

Source: Coin Metrics Network Data Charts

Despite this shift in trading volume, long-term BTC holders appear relatively undeterred. The following chart shows the amount of BTC supply that’s been revived (i.e. sent as part of a transaction) after remaining inactive for at least 1 year. There was a small spike (17.56K BTC) on May 12th, but overall there was relatively little 1 year revived supply compared to earlier in 2021.

Source: Coin Metrics Network Data Charts

Transfer value days destroyed paints a similar picture. Transfer value days destroyed is calculated by multiplying transfer value by the amount of days that the coins being transferred last moved on-chain. This gives older coins a much higher weight. For example, a coin that had not been transacted in 100 days is weighted 100x more than a coin that had been transacted 1 day ago.

BTC days destroyed reached 20.86M on May 12th, but was still well below highs from earlier in the year. For context, it reached 19.34M on May 6th, 25.4M on April 27th, and 38.44M on April 6th.

Source: Coin Metrics Network Data Charts

BTC spent output profit ratio (SOPR) dropped below 1 on May 15th to its lowest level since February 27th. BTC SOPR is a ratio of bitcoin’s price at the time UTXOs are spent to its price at the time they were created. In other words, it’s a proxy for price sold divided by price paid.

A SOPR below 1 signals that investors are selling at a loss. This suggests that some investors who bought recently, while BTC price was near all-time highs, have capitulated and are selling their holdings. Historically, a SOPR of below 1 has corresponded with local cycle bottoms. However, it’s important to note that SOPR is an approximation and not an exact measure of profitable transactions. Not every bitcoin transaction is a trade, which means that not every transaction represents selling in or out of profit.

Source: Coin Metrics Network Data Charts

Lastly, BTC perpetual futures average funding rates have come in closer to zero, at times even dipping negative. Negative funding rates (or close to them) are another signal that bullish sentiment has reset and that the local market cycle is nearing a bottom. Of course, this isn’t always guaranteed to hold true, but it has been a relatively reliable indicator so far throughout 2021.

Source: Coin Metrics Market Data

It remains to be seen exactly where BTC and the rest of the crypto market goes from here. The crypto ecosystem continues to evolve at a rapid pace, and macro uncertainty still abounds. But with Bitcoin due for some major upgrades later this year, it's no surprise that BTC veterans appear to be weathering the storm and continuing to hold for the long-term.

Network Data Insights

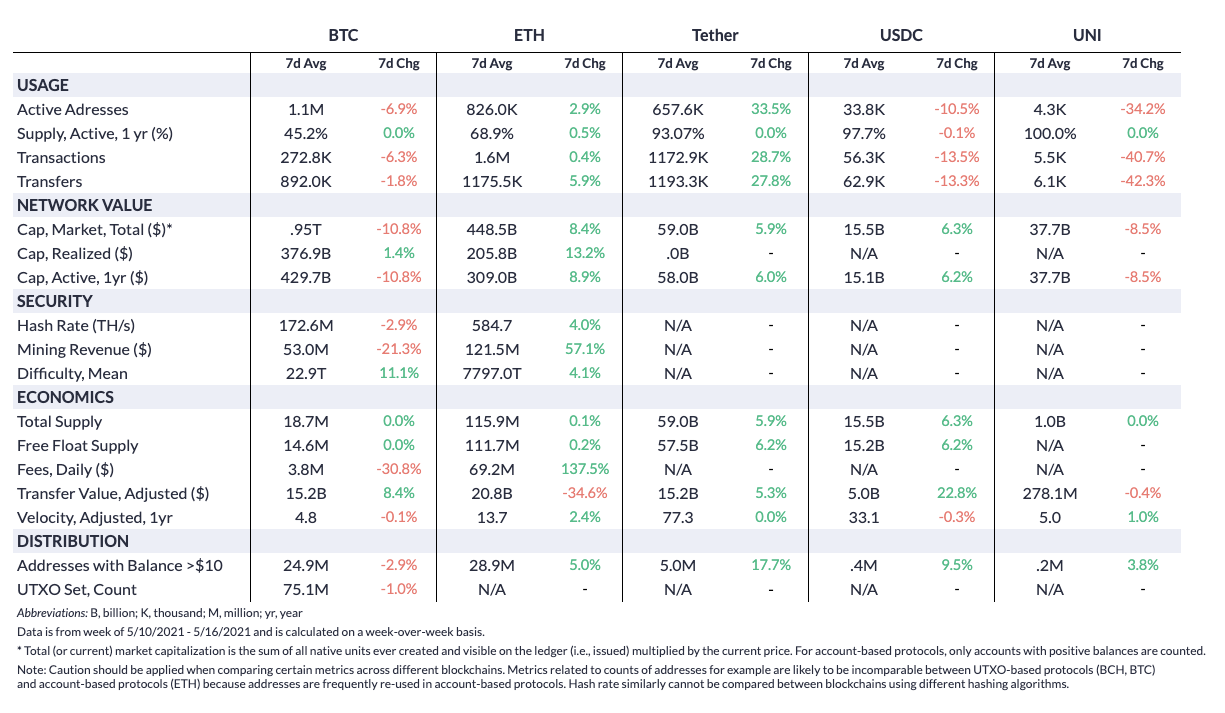

Summary Metrics

Source: Coin Metrics Network Data Pro

Ethreum (ETH) continued its hot streak last week, briefly topping $4,300 before cooling off over the weekend. As a result of all-time high prices, a relatively high number of transactions, and a surge of imitation DOGE coins (more on this below in the Network Highlights section) ETH transactions fees rose over 137% week-over-week. Ethereum mining revenue grew by 57.1% thanks to the big surge in fees.

Tether also continued its strong growth, with active addresses growing 33.5% week-over-week. Tether supply increased by close to 6% on the week to a total of over 59B.

Network Highlights

Ethereum gas prices temporarily dropped to their lowest levels all year after the gas limit was raised on April 22nd. But over the last week average gas price climbed back to close to 300 GWEI as an explosion of new DOGE imitator coins clogged up the network.

Source: Coin Metrics Network Data Charts

High gas prices combined with a new all-time high ETH price and a record number of transactions caused the total amount of ETH fees to soar. On May 11th total ETH fees surged to a new high of $117M.

Source: Coin Metrics Network Data Charts

Then, Vitalik stepped in. Ethereum founder Vitalik Buterin was initially sent billions of dollars worth of Shiba Inu (SHIB) tokens as well as several other meme tokens under the assumption that he would be unlikely to sell or transfer the coins. But on May 12th Buterin began offloading the tokens and donating them to the India COVID-Crypto Relief Fund and other charities.

After Buterin began to offload the tokens at around 17:30 UTC, SHIB price started to drop. This caused some SHIB holders to panic and rush to sell off their tokens on Uniswap and other decentralized exchanges. This led to temporarily escalating gas prices as people rushed to be the first to cash out before prices fell.

Each dot on the below chart represents the average gas price of an individual Ethereum block. For more on how Ethereum gas mechanics work and how things will change with the upcoming EIP-1559 upgrade, check out our in-depth research report: The Ethereum Gas Report.

Source: Coin Metrics Network Data Pro

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hiring! See our open positions in Engineering, Data Science, Research, and more here.

Check out our new market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.