Coin Metrics' State of the Network: Issue 125

Tuesday, October 19th, 2021

Get the best data-driven crypto insights and analysis every week:

Bitcoin Bullishness Returns As ETF Launches

By Nate Maddrey and Kyle Waters

On Friday October 15th BTC broke above $60K for the first time since April of this year. With the first bitcoin futures ETF in the US set to begin trading today on the New York Stock Exchange, on-chain data suggests that bullish conditions have returned.

Source: Coin Metrics Reference Rates

The market value to realized value (MVRV) ratio has historically been one of the most accurate on-chain indicators for gauging BTC market cycles. Throughout the 2013, 2017, and 2021 runs an MVRV of 3.0 or above has indicated a local price top. At the other end of the spectrum, an MVRV of 1.0 or below has signaled the bottom of a cycle. For a deep dive on how MVRV is calculated check out our On-Chain Indicators Primer.

In addition to levels of 1 and 3, an MVRV of 2.0 has been an important level - an MVRV of 2.0 or above has aligned with the major bull runs. For example BTC MVRV crossed 2.0 on Dec 16th 2020 just as BTC price topped $20K for the first time. It dropped back below 2.0 on May 12th as news of China’s miner crackdown started to break. Similarly, it passed 2.0 in late April 2017 and fell back below in January 2018.

BTC free float MVRV passed above 2.0 on October 11th for the first time since May 11th. The version of MVRV used in the below chart is calculated using our free float supply metric which excludes illiquid supply.

Source: Coin Metrics Network Data Charts

Historically, BTC has typically led the way into bull runs following a rotation into smaller-cap assets. The following chart illustrates how this cycle played out earlier this year.

The CMBI10EX index (Coin Metrics Bletchley Indexes) consists of the 9 largest non-bitcoin cryptoassets weighted by their free float market-cap. Since the CMBI10EX excludes bitcoin it can be used to track bitcoin’s performance compared to the other major cryptoassets.

BTC had its greatest returns during the beginning of the year, with prices peaking in April. Then the CMBI10EX, shown on the right axis, peaked in May, with a major surge after BTC’s run. But BTC is surging relative to the rest of the market again in October, signaling the potential start of another bull rally.

Source: Coin Metrics Network Data Charts

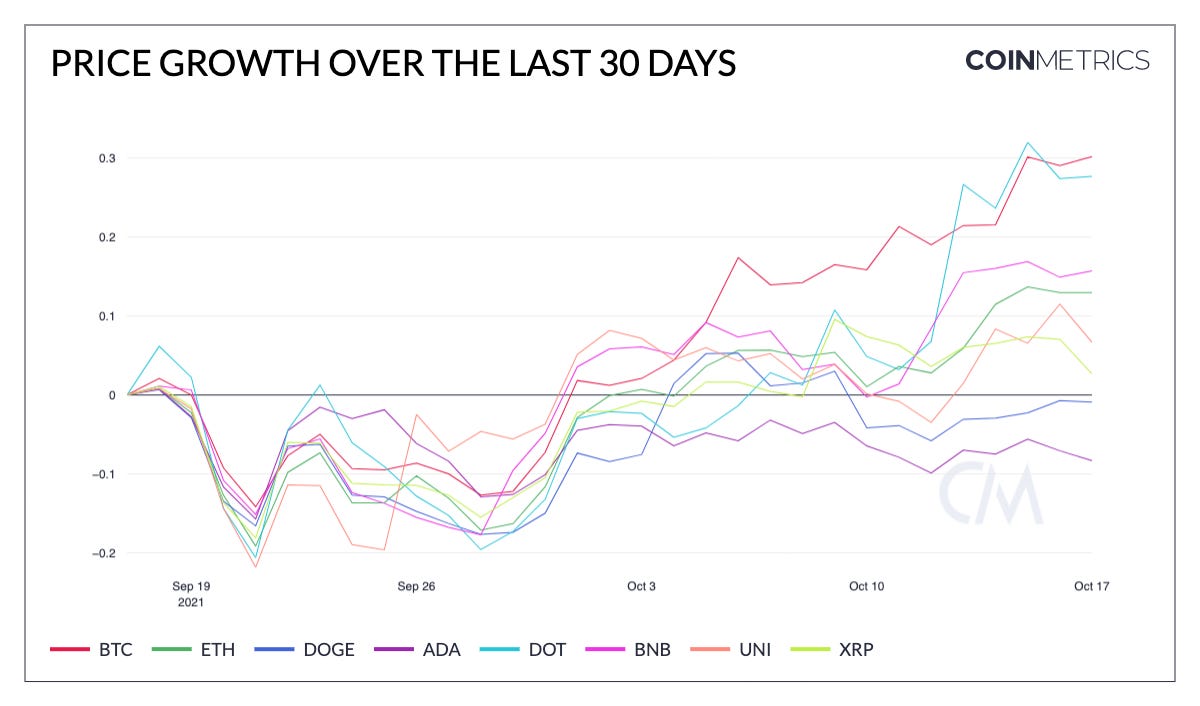

BTC has led the way going into Q4, outperforming most other major cryptoassets over the last 30 days. BTC is up about 30% over the last month, compared to 13% for ETH.

Source: Coin Metrics Network Data Charts

A big catalyst in the recent run-up has been renewed talks of a Bitcoin ETF finally getting approved in the US. Competition for the first US approved spot Bitcoin ETF is at its highest level ever, with prominent firms including Bitwise announcing plans for an ETF over the last few weeks, and Grayscale reaffirming their plan to convert their Trust into an ETF. Q4 is poised to be a big quarter for Bitcoin ETFs, with a long list of SEC ETF decisions (spot and futures based) on the horizon.

Additionally, anticipation over futures based US Bitcoin ETFs has been building for weeks leading up to today’s launch. Over the summer SEC chair Gary Gensler hinted at the possibility of approval of a Bitcoin CME futures ETF. Then on October 14th the SEC Investors Education Twitter account tweeted out information about investing in Bitcoin futures contracts, adding more fuel to the fire.

In addition to potential ETFs, BTC on-chain fundamentals have pointed to a resurgence over the last month. BTC transfer value (adjusted for self-sends and other non-economic activity) has spiked to a new all-time high, reaching over $31B on October 6th.

Source: Coin Metrics Network Data Charts

Bitcoin hash rate has also mostly rebounded after a precipitous drop-off in May. Over the last five months a large amount of Bitcoin hash power has shifted from China to the US following the Chinese government's crypto mining ban. The US has now reportedly emerged as the largest Bitcoin mining center, while China’s mining share has dropped to nearly zero.

But despite the shift towards the West, BTC institutional interest appears to have slowed down after February. Large addresses (holding at least 1K BTC) declined after peaking in February, and flatlined after May.

Source: Coin Metrics Network Data Charts

Similarly, CME futures trading volume also peaked in late February and has since declined. CME futures are another preferred way for institutions to get BTC exposure. Unlike many other crypto derivatives platforms, the CME is regulated in the US and is already widely used and trusted within traditional finance.

Large trades on centralized exchanges are another potential sign of institutional volume. The charts below show the percentage of daily trading volume grouped by trade size for a selection of exchanges.

Source: Coin Metrics Market Data

Each colored region represents a range of trade sizes and shows each grouping's relative share of total volume. For example, the bottom region in light green shows the percentage of volume from small retail trades of up to $1,000. Moving up each chart, the darker-colored regions show how much volume is sourced from larger trades that are less likely to be executed by average retail traders. This is important because it might help infer retail vs. institutional volume.

For a few exchanges, the relative share of volume from trades of over $100K and up to $1M (dark blue) has been increasing, potentially pointing to growing institutional volume. For example, the percentage of BTC-USD volume on Kraken from trades between $100K and $1M has grown from ~8% to ~22% over the last two months. However, smaller trades still make up most of the spot volume for these exchanges, and trades over $1M are still quite rare. But with order book depth maturing for BTC and ETH spot markets, some exchanges might now have the necessary liquidity to handle larger trades.

But it is worth noting that not all small trades are necessarily completed by individual retail traders. For example, when MicroStrategy first bought $250M of BTC last year through Coinbase Prime, Coinbase’s execution algorithm split the order into close to 200K child fills over the course of five days, with an average fill size of less than 0.3 BTC to minimize price impact. Additionally, some large trades are conducted via OTC (over-the-counter) trading that connects two parties directly and takes place off the open exchange. Ultimately, this makes searching for institutional volume a difficult task.

Although the data available suggests institutional activity has tapered in the second half of the year, the successful introduction of a US based ETF may help renew some institutional interest. Bitcoin futures ETFs will make it even easier for wealth managers, family offices, and other investors to get BTC exposure within familiar frameworks. But just as importantly, it will also help further legitimize crypto as an asset class, and help reassure traditional investors that bitcoin is here to stay.

To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Despite the rally in price, BTC and ETH active addresses were down over the week with BTC active address count down 2.9% and ETH active address count down 7.1%. However, there are signs of continued adoption. The total number of ETH addresses with a balance between 0.01 and 1 ETH surpassed 17M on October 18th, after having just crossed 16M on September 5th.

Network Highlights

NFT drops continue to be a source of short-term spikes in gas prices on Ethereum. This past Sunday (10/17), a new profile picture project called doodles launched leading to mean gas prices as high as 7,000 GWEI. In USD terms, some blocks had a median transaction fee of over $16K.

Source: Coin Metrics Network Data Pro

The specific dynamics of this drop likely incentivized some ETH users to pay such high fees. The team behind the doodles project split the NFT launch into two separate parts: 50% of supply was offered in a private sale for whitelisted ETH addresses (early contributors and Discord members) and a subsequent public launch for the remaining NFTs.

Prior to the public launch, some individuals who claimed the NFTs in the private sale received bids on those NFTs on the secondary market on OpenSea, establishing a floor price of over 1 ETH. Knowing that there was a floor price already set by the market, users could therefore rationalize paying high fees in addition to the .123 ETH mint price (per NFT) if it meant turning around and selling that NFT for more than what was paid in gas. The ensuing gas price war and heightened base fees led to multiple blocks with negative net ETH issuance with some blocks having a net issuance of -20 ETH.

Overall NFT activity still remains high despite a recent rise in ETH fees and price. As many NFTs are priced in ETH, it will be worth watching if NFT activity ticks down at all if ETH USD price breaks new all-time highs.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Coin Metrics is hosting its first Boston crypto meetup on October 27th.

This in person event will feature a live discussion of the latest State of the Network followed by a Q&A with the audience.Check out our market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

Also check out the Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.

© 2021 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is’ and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.