Get the best data-driven crypto insights and analysis every week:

The Best of State of the Network in 2022

In this special edition of State of the Network, we look back at some of the Coin Metrics Research team’s favorite issues from 2022. Data visualization has always been an important part of SOTN, and this year, we’ve segmented content by our favorite charts and visuals.

First, a quick macro-level look at State of the Network in 2022. We condensed all SOTNs down into a word cloud, to get a better sense of our most-discussed topics over the past year.

Top-Mentioned Words in State of the Network in 2022

Please enjoy and we look forward to bringing you more insights in 2023!

Issue 137: A New Look at the Data Behind Some of the Largest Airdrops on Ethereum

In Issue 137, we analyzed the data for some of the biggest token distribution events (commonly known as “airdrops”) on Ethereum. We studied the different distribution models and behavior of claimees. We were particularly interested in the sets of claimants and the overlap between airdrops. We created the venn diagrams below to show the overlap in the number of addresses who claimed tokens in both of the two given airdrops.

Issue 145: Ukraine Receives over $45M in Crypto Donations

In Issue 145, we studied the flow of crypto donations to the Ukrainian government at the onset of Russia’s invasion of Ukraine. With Coin Metrics’ ATLAS, we were able to track in real time $45M worth of BTC, ETH, and stablecoins sent to Ukrainian government-controlled wallets in the immediate days after the start of the war. The funds were eventually used to purchase everything from medicine and packed lunches to bulletproof vests.

Issue 153: The BAYC Burn: Breaking Down the Otherside Gas War

In Issue 153, we conducted an economic analysis of Yuga Labs’ metaverse land mint that caused the largest spike in Ethereum gas fees in the history of the network. We explained the market design behind Ethereum gas and analyzed the series of events that led to $150M worth of fees being spent during the mint. The chart below highlighted the sudden rise in Ethereum gas fees that night.

Issues 160 & 161: Mining Data Specials

In Issues 160 and 161, we reported on the mining ecosystem in the wake of the spring contagion brought on by the collapse of Terra/Luna. In Issue 160, we showed how crypto data analysts can better track miners’ holdings through finer-tuned heuristics on activity levels.

In Issue 161, we analyzed the profit margins of different Bitcoin mining hardware in the face of rising industrial electricity rates and sliding BTC spot prices.

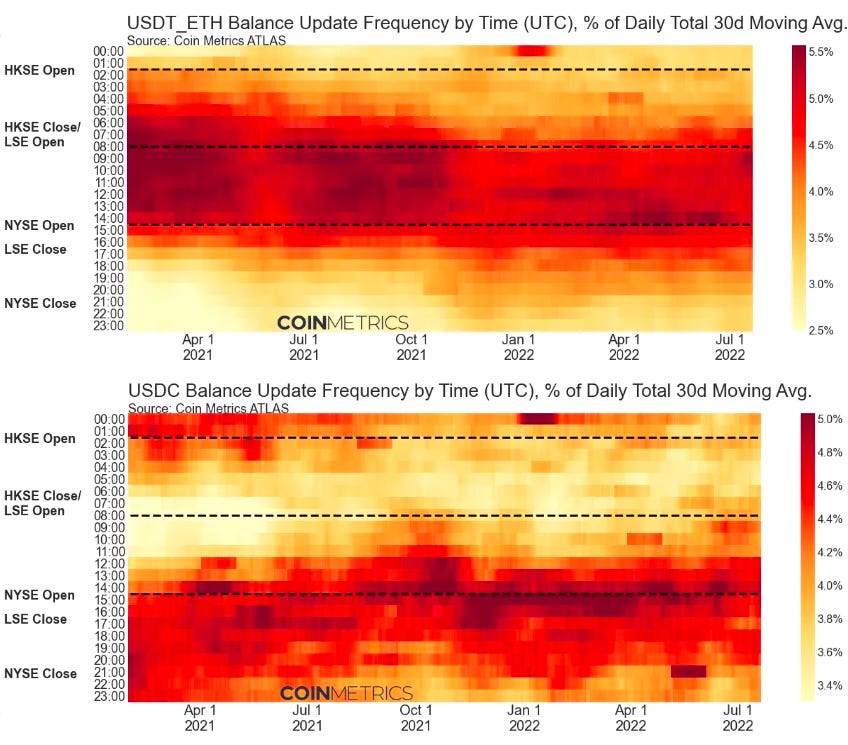

Issue 165: Exploring the Time-Based Patterns of Blockchain Activity

In Issue 165, we again used CM ATLAS data to investigate when certain crypto assets are most active. For example, we showed how most USDC activity is concentrated during New York business hours while Tether (USDT) activity is most active during Asian/Pacific business hours.

Issue 166: Ethereum After EIP-1559

In Issue 166, we completed a one-year retrospective on Ethereum’s summer 2021 change to its fee market, EIP-1559. Concurrently, we released a technical report titled “What is Gas on Ethereum, Why is it Needed, and How Do I Get Some?” where we expanded on the subject of EIP-1559 and its effectiveness through detailed data on gas costs before and after the upgrade.

Issue 170: Mapping Out The Merge

We covered Ethereum’s massive upgrade — The Merge — extensively in 2022, with our most thorough analysis bundled into our report: Mapping Out The Merge.

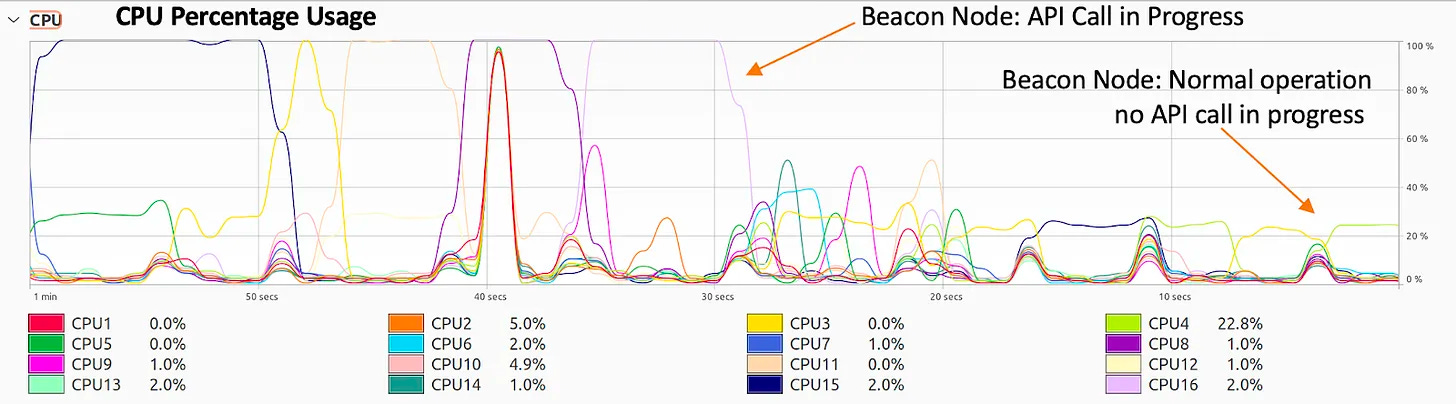

Issue 176: Running an Ethereum Node from your Home

In Issue 176, we struck a more instructional tone, walking readers through the process of setting up and running an Ethereum node from scratch, from the comfort of your home.

Other Notable Issues

Issue 164: The Ethereum Crowdsale 8 Years Later

Issue 169: The Options Market and The Merge (by Data Always)

Issue 180: Introducing datonomy™: A Digital Assets Taxonomy

Issues 181 & 182: Coverage on FTX’s Collapse

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

You can see previous issues of State of the Network here.