Coin Metrics’ State of the Network: Issue 220

From East to West: the Global Pulse of Stablecoin Transactions

Get the best data-driven crypto insights and analysis every week:

From East to West: the Global Pulse of Stablecoin Transactions

By: Lucas Nuzzi, Tadhg Papillaud Looram, and Kyle Waters

INTRO

Last week, PayPal unveiled its plans to release a USD-denominated stablecoin, PYUSD. This took the industry by surprise with many hypotheses around what motivated the US payments giant to do this. Undoubtedly, the release of FedNow in July has sent a message to payment processors like PayPal: the commoditization of money transfers is coming. Based on the company’s messaging around PYUSD, they see crypto as a new avenue for services and features previously unavailable. We expect more service providers to follow suit as their services become commoditized.

Stablecoins offer an entirely new approach to banking services. One could envision how neo-banks could leverage stablecoins to offer their users part of the yield accrued from deposits. Although still niche, some existing stablecoins, such as TrueUSD (TUSD) and OriginUSD (OUSD), already implement that via rebasing, whereby part of the interest received on reservers is distributed to all users by simultaneously increasing their balances. Beyond simple payments, stablecoins also grant their users access to a host of new services that fit into the web3 umbrella.

From a data perspective, this development is exciting. PYUSD will be issued on the Ethereum network, which allows us to track how, when, and where the currency gets used. We have written extensively about the facets of stablecoin data, and how to evaluate their underlying risk and usership. In this report, we want to share a new approach to estimate the geographical preference around stablecoins. Like previous approaches (SOTN issues: #50, #114, #165), we leverage something called seasonality analysis to estimate the adoption of a stablecoin in specific geographical locations.

Seasonality analysis is an essential tool in understanding the cyclical nature of business activities. Since different geographical regions have unique peak activity times (business hours), understanding the seasonality of these transactions can help reveal patterns and concentrations in on-chain volume. This can provide a better understanding of how various market factors, such as regional regulations, economic health, investor behavior, and technological penetration, influence stablecoin usage. In addition, it can also provide valuable insights into the liquidity, transaction speed, and overall health of the stablecoin market.

Analyzing stablecoin volume through a geographic lens can assist in identifying areas where stablecoins are used more frequently, suggesting a higher acceptance or need for this type of digital asset. It could also highlight potential growth areas, regulatory challenges, and investment opportunities. Moreover, identifying geographical concentration can enable blockchain developers, investors, and policy makers to make better informed decisions. For instance, they can focus their marketing efforts, investment strategies, and regulatory oversight on areas where the volume of transactions is high.

METHODOLOGY

To effectively analyze the geographic distribution of stablecoin volume, our methodology focuses on capturing transaction data by UTC time zones and their corresponding business hours. This approach acknowledges the fact that while stablecoins operate on public blockchains 24/7, peak trading volumes are likely to occur during typical business hours within each geographical location. Therefore, the methodology revolves around collecting hourly transaction data for all UTC time zones, specifically during business hours.

To achieve this we leveraged CoinMetrics' Atlas Transactions endpoint and extracted the exhaustive set of on-chain transactions for USDC and USDT. We then turned to the Atlas Balance-Updates endpoint to identify specific transactions related to treasury operations, issuances, redemptions, and fees. By filtering out these specific transactions, we obtain a clean dataset showcasing on-chain activity. This refined approach offered a more granular and precise interpretation of stablecoin usage.

We then aggregated transaction volumes, grouped by hour which are anchored in the UTC+0 time frame. We then translated the date-time of our base UTC+0 to encompass all other UTC time zones, spanning from -12 to +14.

Lastly for each UTC offset, we parsed through all transactions that took place during business hours (9am to 5pm, Monday through Friday), and once more grouped and summed transactions to get daily volume by UTC. Repeating this process across all UTC timezones, results in a detailed, global picture of stablecoin volume distribution across geographical locations. This provides a holistic representation of on-chain transaction volume across global time zones, laying the groundwork for a thorough and expansive analysis. This methodology allows for the mapping of each stablecoin and determines where and when the volume is most significant, providing a more granular understanding of the global stablecoin marketplace.

USDT Aggregation Metric

In light of Tether's (USDT) multi-chain framework, offered across several blockchain networks, we formulated a unified asset, amalgamating Tether on Ethereum, Omni, and Tron (USDT_ETH, USDT_OMNI, and USDT_TRX). Mirroring the approach delineated in the above methodology, we processed the specific assets: “usdt_eth, usdt_trx, and usdt_omni”. Post data collection, we aggregated daily on-chain user volume, having methodically sieved out transactions associated with the operational facets described earlier. Finally we calculated total USDT volume, by merging and aggregating the volumes of USDT_ETH, USDT_OMNI, and USDT_TRX. This culminated in a metric that captures the majority of USDT's on-chain volume.

FINDINGS

Our analysis focused on stablecoin volume from January 2022 to July of 2023. As such, it encompasses some of the most disruptive events to take place in the industry, such as the collapse of Terra’s UST, the bankruptcy of FTX, and subsequent failures, such as Celsius, BlockFi, and unfortunately many others.

To proxy for geographical variation for regions of interest, we tracked volume during stock market operating hours. We keyed into specific UTC time brackets corresponding to major stock markets and calculated regional volume by averaging daily volume across those UTCs. As an example, for Asia we focused on the Tokyo, Hong Kong, Shanghai, South Korea Stock Exchanges and the National Stock Exchange of India, which corresponds to UTC+9 , UTC+8, UTC+8 , UTC+9 , UTC+5.5, respectively. To identify major trends, we deployed a double smoothing 10-day average which applies a moving average twice to iron out short-term fluctuations and detect underlying patterns.

Circle USD (USDC), one of the most popular stablecoins today, faced a lot of turbulence as these events unfolded. As a stable store-of-value, USDC faced noticeable spikes in demand as these events push cryptoasset prices down. From a geographical preference point of view, the Americas region clearly has a preference for USDC over other regions, as evidenced by the consistent volume dominance. This might not come as a surprise given Circle is a US-domiciled company based in Boston, MA and naturally has better recognition and business activities focused in the West.

The first noticeable spike in May of 2022 was driven by the collapse of Terra USD (UST), one of the most popular stablecoins at the time. It is possible that, as UST began depegging from USD, users transitioned their stablecoin positions to USDC. By the middle of the year and as the fallout of Terra was better understood, USDC volume predominance shifted, with Europe followed by Asia respectively taking the lead. The FTX shockwave that followed in Q4 was felt across jurisdictions. Volumes hit ATHs all around and there was an overall flight to safety as contagion unfolded in all regions.

USDC volumes remained high heading into 2023 as the collapse of FTX impacted banks with exposure to crypto, such as Silvergate. Its closure in early March meant the end of the Silvergate Exchange Network (SEN), which offered crypto exchanges instant settlement services. Before Silvergate’s closure, SEN facilitated $1.3B of volume per day in the fourth quarter of 2022. Then, the closure of Signature Bank in March ended institutional crypto customers’ access to Signet—a money transfer system that served as a vital linkage for traditional banking infrastructure and crypto-market participants. The increased friction between crypto exchanges and traditional banking infrastructure might have contributed to the sustained increase in USDC volume in 2023.

On the other hand, Tether (USDT)—the largest stablecoin today by market cap—displays a strikingly different pattern. While the spikes in volume take place roughly at the same time, the geographic preferences are different. Volume is predominantly dominated by the Europe-Africa region, followed by Asia and the Americas. Unlike USDC, the largest spike in volume took place in 2Q22 with the collapse of Terra. While the collapse of FTX did have an impact in volume, it was temporal and not as pronounced as USDC.

Another particularly interesting insight with USDT is that decreases in volume appear to coincide with regional holidays such as Orthodox Christmas and Chinese New Year. These occur in the months of January and February, which saw volume decreases in 2022 and, more intensely, in 2023. We have previously witnessed the impact of these holidays in Bitcoin’s on-chain volume and it is interesting to see a similar trend in USDT.

Also of note, in Q2 of 2023, a sharp increase in volume dominance in the Americas region was observed. As alluded to earlier, this coincided with the banking crisis in the United States and the collapse of SVB. Increased regulatory scrutiny of crypto in the US culminated with the preemptive and arguably unwarranted closure of Signature Bank. It is possible that the increase in USDT volume in the Americas reflects concerns in the region around stablecoins with exposure to the US banking system, such as USDC and TUSD.

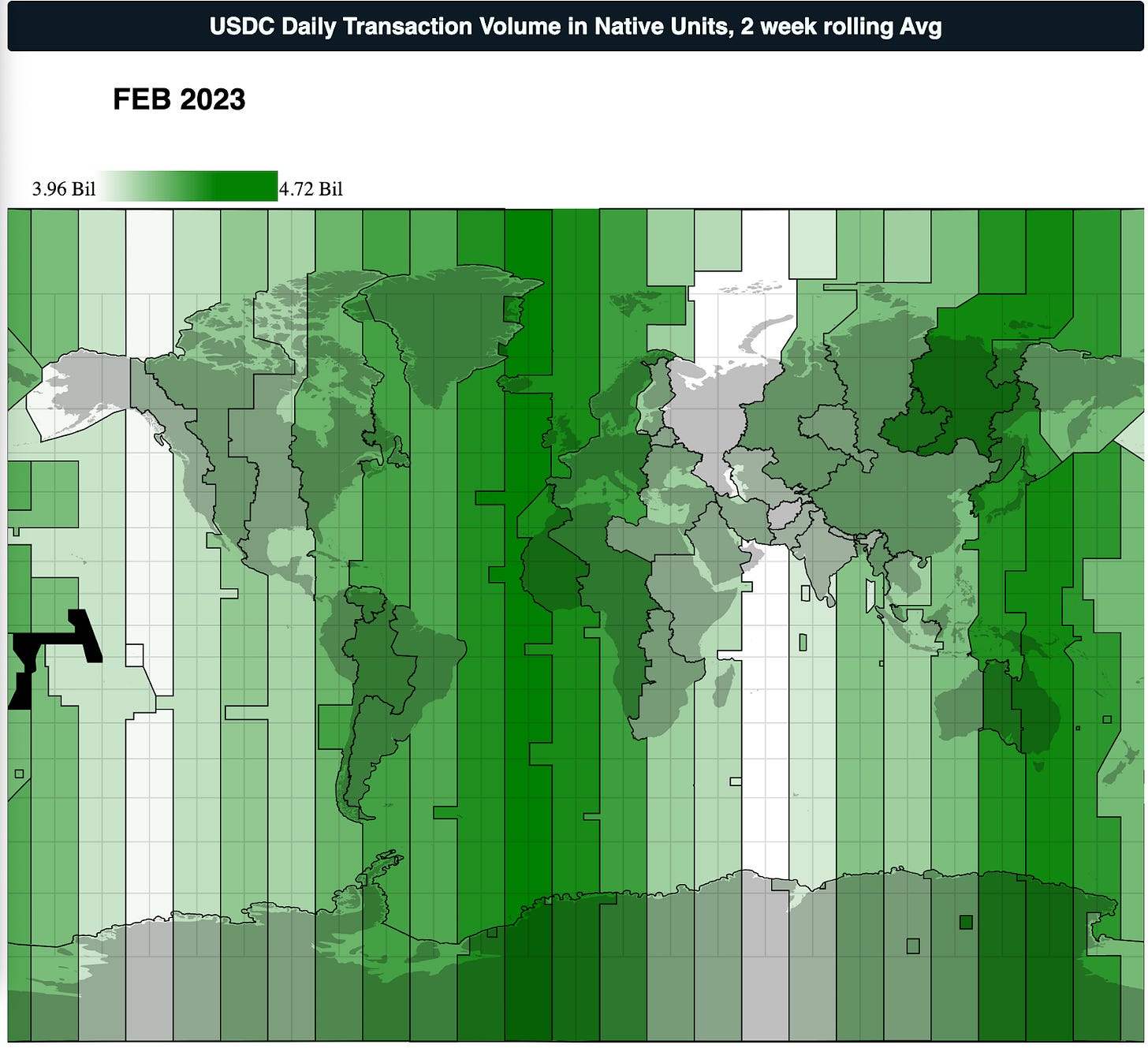

The cyclical nature of on-chain volume on specific regions can also be visualized using a mercator map projection. This makes it easier to visualize volume dominance on specific UTC time zones over time. As the dynamic visual below showcases, USDC has a clear dominance in the West. Time zones in Europe-Africa and Asia rarely lead USDC volume, shown below on a green scale.

The volume dominance of USDT in Europe-Africa can also be visualized this way. Time Zones in these locations are often leading on-chain volume. However, the swings in demand in the Americas, especially in March of 2023 are also easily discernible.

In addition, this type of map analysis can allow for the identification of sudden anomalous deviations.

For instance, throughout February of 2023 we observed sporadic upticks across the map, notably from the east, this aligns with figure 1, where wee see an overall increase in USDC volume in Asia while declines observed in N. America during this time.

In February, Hong Kong introduced progressive regulations for crypto-related operations, allowing non-accredited investors to trade certain digital assets on licensed exchanges. In addition, Hong Kong is also making strides towards legalizing stablecoins demonstrated by KuCoin and Circle, unveiling a unique stablecoin linked to offshore Chinese yuan (CNH). In tandem with these developments, USDC activity picked up in the east.

CONCLUSION

In this report, we introduced a new approach to establish geographic dominance of stablecoins. Our analysis of volume dominance focused on events from January 2023 to July 2023 and revealed distinct patterns and preferences as the industry went through turbulent times. Notably, the Americas exhibited a marked preference for USDC, likely due to its domestic roots, whereas USDT demonstrated stronger ties to the Europe-Africa regions. External factors, from the collapse of notable crypto behemoths to regional holidays, clearly influenced trading volumes and geographical predilections. As the stablecoin landscape evolves, with entities like PayPal entering the fray and regulatory developments continuing in the US and Europe (with MiCA), understanding these geographically-driven trends will be pivotal for stakeholders, from investors to policymakers, to navigate the ever-evolving crypto landscape.

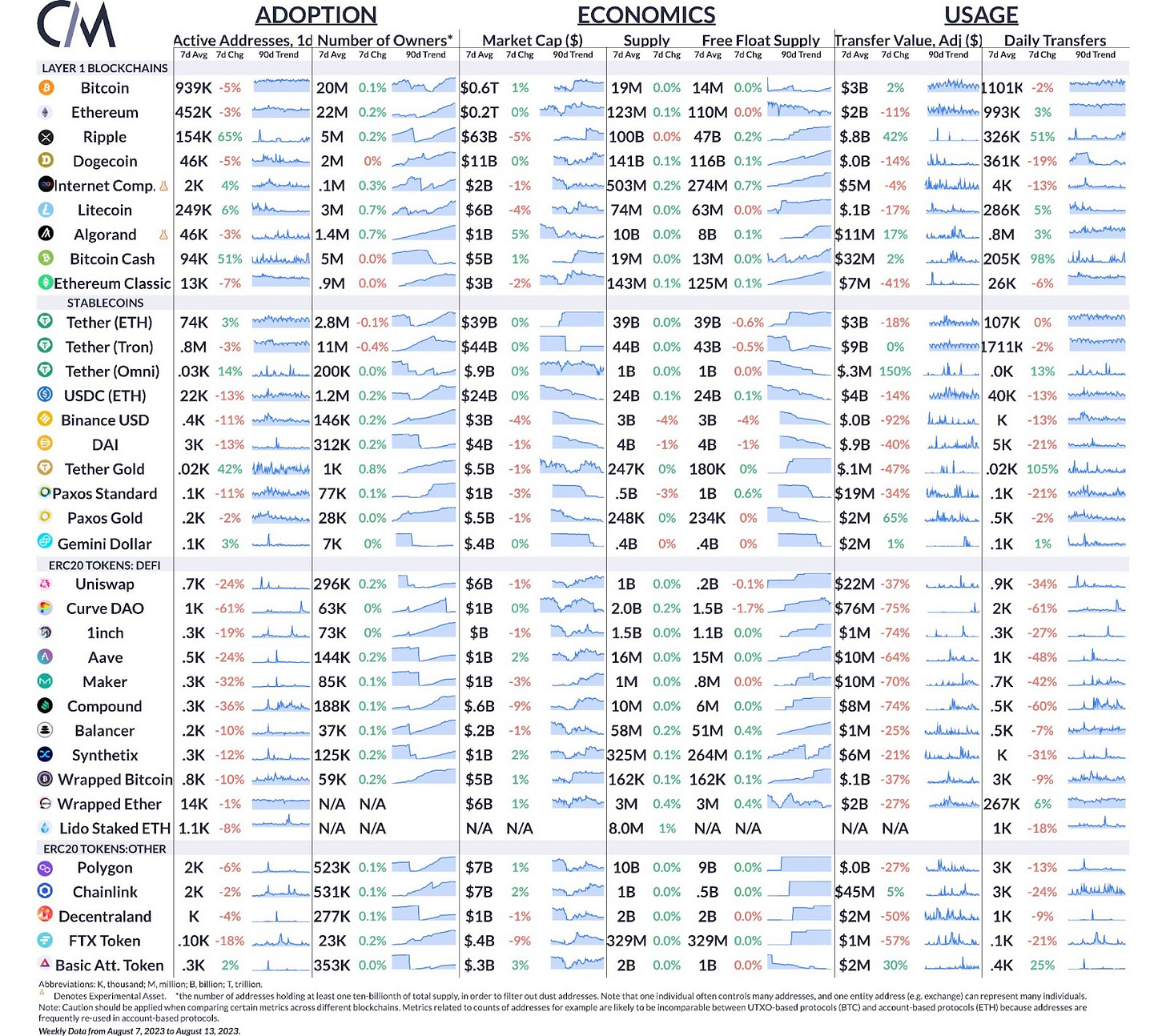

Network Data Insights

Summary Metrics

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Check out our recent long-form reports in our catalog of original data-driven research.

Check out last week’s issue of State of the Market.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.