Coin Metrics’ State of the Network: Issue 224

One Year Since The Merge

Get the best data-driven crypto insights and analysis every week:

One Year Since The Merge

By: Matías Andrade Cabieses and Kyle Waters

Introduction

This Friday will mark one year since Ethereum’s landmark upgrade, dubbed The Merge, was grafted onto the timeline of the first smart contract platform’s continued evolution. Crafted from years of intensive research and development, The Merge brought Ethereum to a Proof-of-Stake model, redefining the network's security and economics on a fundamental level. This shift represented the most significant update to Ethereum since its launch in 2015.

However, The Merge wasn’t the end goal of the Ethereum core development team. Rather, it forms the foundation for the evolution and future development of the Ethereum network, bringing together more stringent economic security, as well as paving the way for greater inclusion of the L2 scaling paradigm. In this issue of the State of the Network, we revisit the predictions we made about Ethereum’s now-defunct mining operations, take a look at critical network data to help us understand how Ethereum’s PoS ecosystem continues to evolve, and consider new directions and future upgrades that are currently being worked on.

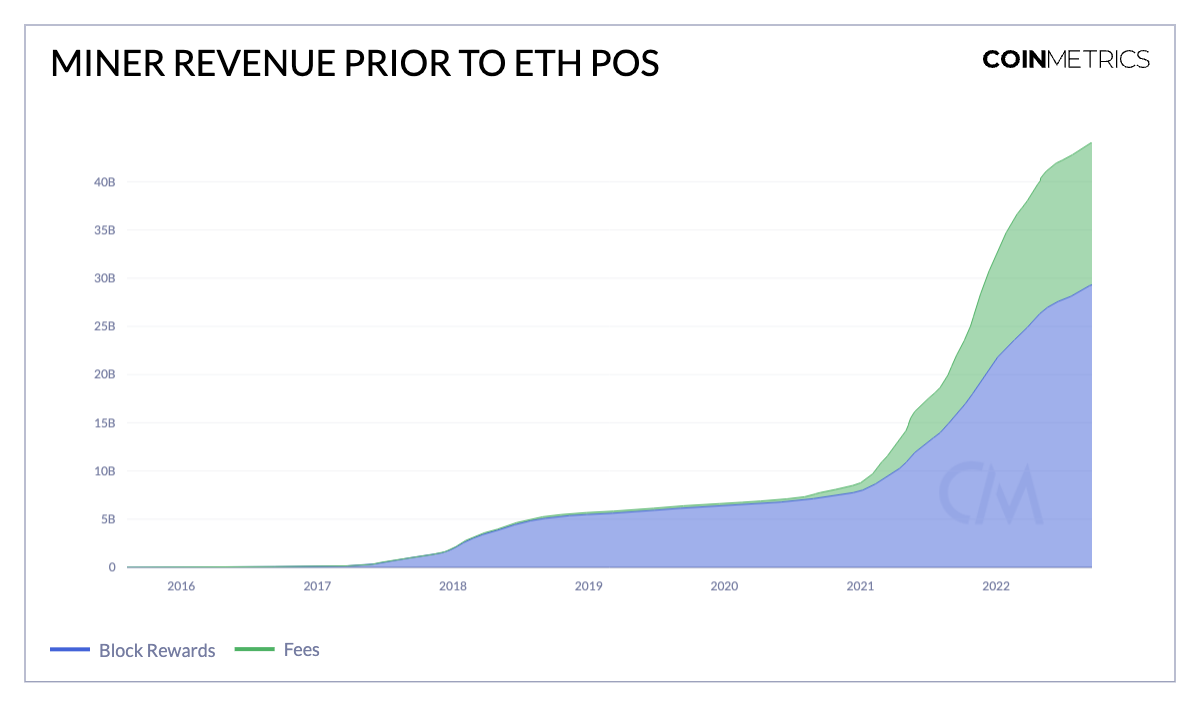

The Fall of Ethereum Miners

Toward the dusk of Ethereum’s Proof-of-Work era, the end of mining was certainly one of the more impactful outcomes of The Merge. At its peak in May 2022, the Ethereum network was secured by more than 1,000 TH/s in compute. It is not surprising, since Ethereum mining was a multi-billion dollar industry, bringing more than $2B a quarter in revenues and accounting for over $40B in cumulative revenues, $30B from block rewards and $11.3B from fees.

Source: Coin Metrics Formula Builder

However, it was all going to come to an end with The Merge and Ethereum’s transition to Proof-of-Stake. Last September, we discussed the prospect of a cascading effect on GPU miners and prices as a result of The Merge, and we forecasted decreasing hardware prices and a dismal landscape of profitable mining opportunities for GPU miners.

Unlike Bitcoin ASICs (special purpose hardware), Ethereum was ‘mined’ with GPUs which are general-purpose devices, with applications in gaming, video editing, graphics design, 3D animation, CAD, and (most recently in vogue), artificial intelligence acceleration. As we explained last year, there was a dearth of comparatively lucrative options for ETH miners. While a few larger industrial-grade miners with higher-quality chips were able to hop seamlessly over to the new AI-driven gold rush for compute resources, this has proven to be the exception, and most smaller enthusiast miners are still left with limited options.

Other PoW chains mineable by GPU, like Ethereum Classic (ETC) or ETHPoW, are chains with much lower activity and applications compared to ETH, leading to a lack of demand for prompt transaction inclusion and thus low fees, as well as a lack of MEV (or, as it is now called, REV) infrastructure. Illustratively, the decoupling trend of ETC’s hashrate and price underlines the decreasing attractiveness of this alternative, even though the surge in hashrate after The Merge suggests that miners flocked to this network even though they are hardly likely to break even and profit over the electricity costs to power their GPUs.

Source: Coin Metrics Formula Builder

Ethereum’s Validator Landscape

Since The Merge, validators have become the principal driving force of the Ethereum network. It is thus crucial to understand the validator ecosystem and its evolution if we are to evaluate the health of Ethereum in its Proof-of-Stake paradigm.

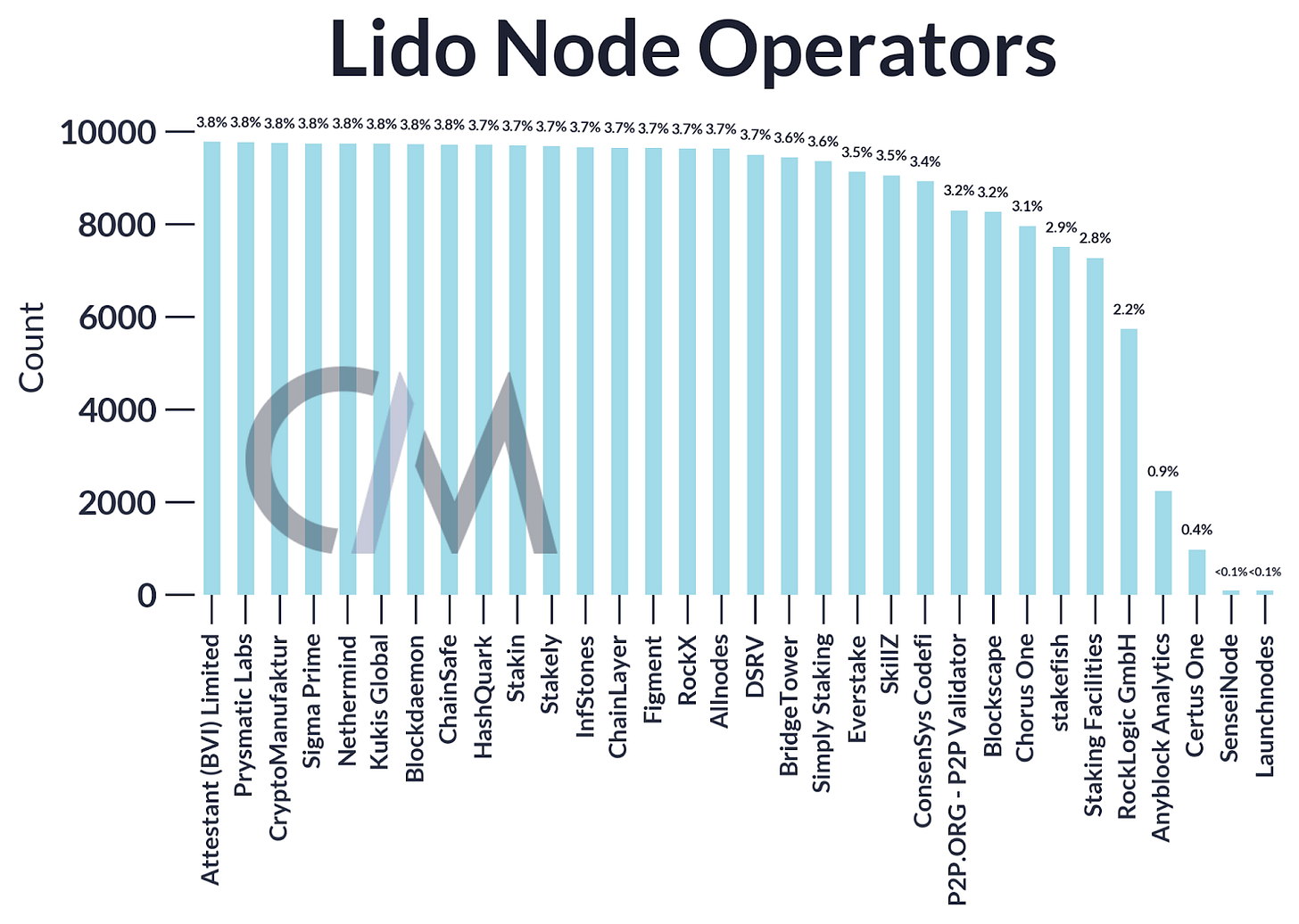

One of the first things to notice is that the largest validator pool by far is under the Lido umbrella, which currently accounts for 30.6% validators out of the total pool of nearly 787,755 currently active validators. A wave of new validators have rushed into Ethereum after the implementation of withdrawals in the “Shapella” upgrade this past April.

Source: Coin Metrics Network Data

Liquid staking has been one of the most popular ways to participate in Ethereum staking for those individuals unwilling to stake independently—either due to a lack of funds totaling 32 ETH needed, a lack of technical knowhow or willingness to run your own node, or simply an interest in keeping these funds liquid instead of locked up in staking, especially until recently before withdrawals were enabled. Lido staked ETH (stETH) is also one of the most important forms of collateral, which brings economic utility to the staked ETH in addition to securing the network.

Source: mevboost.pics, elaborated by Coin Metrics Research Team

However, Lido’s preeminence in the staking ecosystem is not without controversy. There are serious questions regarding the security and threat of a large conglomerate of stakers coming under control of a single entity. This is because, in principle, they could be subject to certain attacks that exploit their large footprint on the Ethereum network, including time-bandit attacks (exacerbated by MEV) and other coordinated attacks. However, this impression is exacerbated by the belief that Lido is a single entity, whereas in fact it is composed of multiple staking operators that run their nodes independently, while selling access and conforming to Lido’s requirements, which also include additional economic protections against coordinated attacks on top of Ethereum’s correlation penalty.

Source: mevboost.pics, elaborated by Coin Metrics Research Team

As we can see from the image above, the distribution of Lido stakers is pretty evenly distributed among different node operators. This further demonstrates that Lido is not inherently centralized but is rather composed of many different parties, without a single node operator surpassing even a 5% stake of Lido’s validator pool. Furthermore, Lido’s node operator distribution is capped at a maximum that is set by the Lido governance mechanism, allowing users to track and decide whether individual node operators are allowed to operate over a specific threshold. Nevertheless, such a single large provider could introduce novel risks to a still-nascent staking ecosystem. This will continue to be a subject of debate as Ethereum continues its evolution.

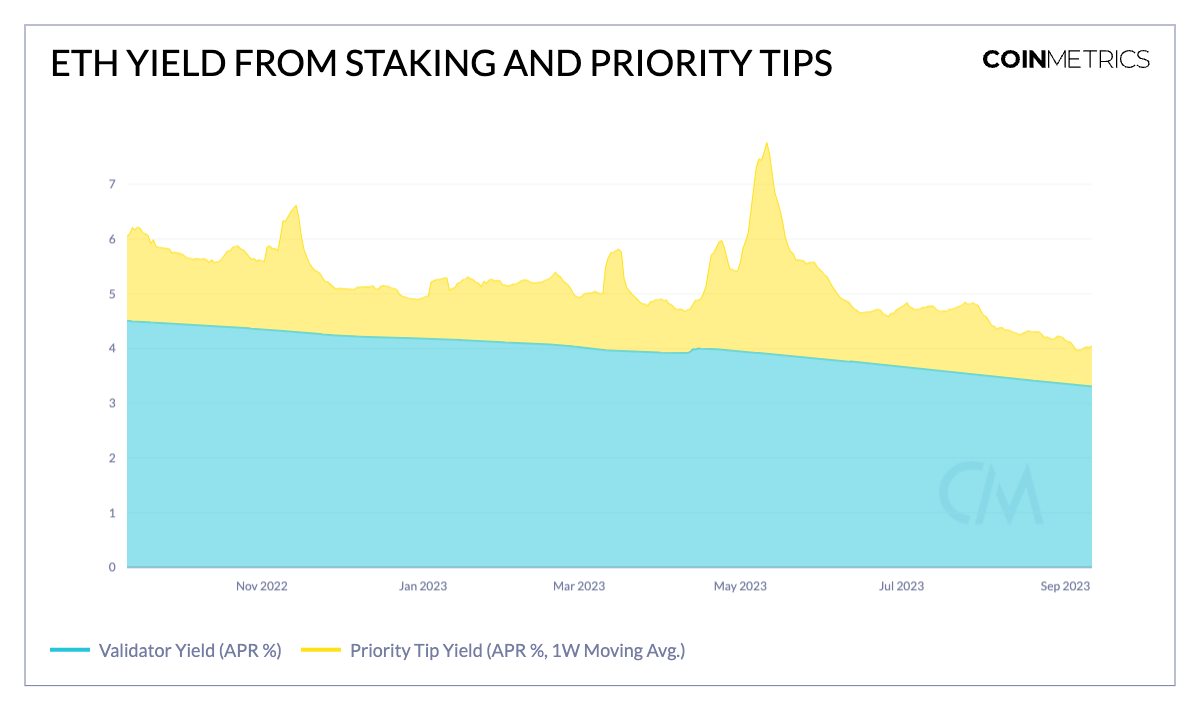

Validator Profitability And Ethereum’s Monetary Policy

It is imperative for the security of the network that the agents in charge of securing and processing transactions are economically sustainable. However, with each new validator that joins the network, the yield to each individual validator is decreased as revenues are shared among all validators. The predictable source of revenue that comes from validator duties, including proposals and attestations, has been decreasing consistently over the last year, with a small blip in April when withdrawals were enabled. This is because this yield is directly related to the number of validators that are currently active on the network. On the other hand, yield earned by validators is variable and a function of user demand and network activity. The average yield from priority tips has contributed around 0.7% to 0.9% to validator yield over the last few months, with some noteworthy spikes as a result of network activity as seen in the chart below.

Source: Coin Metrics Formula Builder

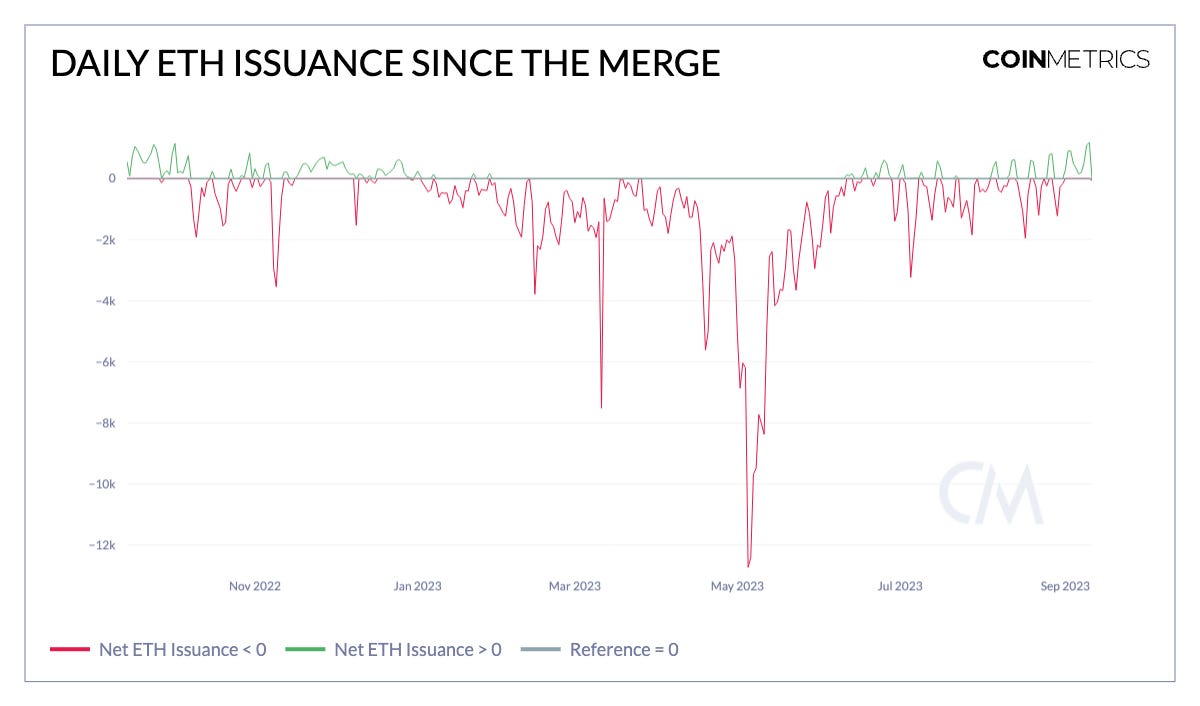

As a result of the base fee burn mechanism implemented in EIP-1559, part of the fees paid to validators is now burnt and therefore completely removed from circulation. So while validators still receive the priority fee, and additionally receive freshly-issued ETH as reward for performing their validator duties, there is a delicate balance that needs to be considered when evaluating whether the Ethereum network as a whole is inflationary or deflationary. As we can see in the chart below, although Ethereum has been deflationary for the most part over the last year since The Merge, it has been trending toward inflationary as of late due to low user activity on the network. Although in balance, Ethereum’s supply has overall reduced by around 300K ETH, or around -0.25% per annum.

Source: Coin Metrics Formula Builder

Ethereum’s Roadmap

Despite notching many successes so far, user and developer ambitions for Ethereum extend far beyond its current set of applications and adopters. The hope has long been that billions may transact and develop decentralized applications on the platform. However, the journey to this grand vision is paved with a series of additional technical upgrades. These upgrades might be highly technical in nature but have clearly understandable goals.

Despite the recent trend towards a lower fee regime, Ethereum's Layer 1 (L1) fees remain a hurdle for high-frequency, low-value transactions. Over the past month, the average transaction fee hovered around $4. While such a fee might be inconsequential for a million-dollar stablecoin transfer, it becomes a significant barrier for applications like gaming, micro-streaming payments, and mainstream consumer-facing apps. The need for a more affordable fee structure is an ever-present nagging pain.

Source: Coin Metrics Network Data

Central to Ethereum's current scalability strategy is the "Rollup-centric roadmap." This approach emphasizes the use of rollups, a layer-2 scaling solution, to enhance the network's throughput. The future introduction of EIP-4844, referred to by close Ethereum watchers as "Proto-Danksharding," offers a specialized “blob” data space and a distinct fee market tailored for rollup data. This upgrade is poised to reshape the fee dynamics, especially as rollup solutions like Arbitrum, Optimism, and Coinbase's newly launched Base L2 gain traction.

Simultaneously, Ethereum is not just scaling in terms of transaction capacity but is also refining the user experience. Account abstraction, another forthcoming upgrade, promises to simplify the often daunting task of managing seed phrases and private keys. By making these cryptographic necessities more user-friendly, Ethereum aims to lower the entry barrier for the average user, potentially ushering in a new wave of adoption and enticing novel use cases.

From an analytical standpoint, these developments will not just be technological milestones but also introduce fresh dimensions in evaluating Ethereum fundamentally. EIP-4844, for instance, will influence the fee market economics, and the subsequent reduction of fees on Layer 2 solutions will necessitate a recalibration of cost analyses, and the economics for rollup operators. Furthermore, the rise of smart contract wallets might alter traditional metrics of adoption, compelling analysts to seek new on-chain indicators.

Following previous customs of naming execution-layer upgrades after cities, the next upgrade on the line is called “Cancun.” The EIP-4844 upgrade is not the only improvement in the Cancun upgrade. Other EIPs include EIP-1153, which aims to reduce fees for storing data on-chain and improve blockspace; EIP-4788, which seeks to improve designs for bridges and staking pools; EIP-5656, which adds minor code changes related to the Ethereum Virtual Machine; and EIP-6780, which aims to eliminate code that could terminate smart contracts to increase contract security. These upgrades have no firm release date as of today, although developers are already busy testing early versions of each improvement proposal. The Cancun upgrade will happen on the execution layer, where all protocol rules reside, while the consensus layer, which validates blocks, will go through its own fork known as "Deneb". The name "Dencun" is a portmanteau of the names of these simultaneous upgrades.

Conclusion

As Ethereum continues to evolve, it's clear that the network is making strides towards its vision of enabling billions of users to transact and develop decentralized applications on the platform. One year has allowed us to evaluate how the change to Proof-of-Stake has affected the network, including changes such as Shapella’s withdrawals, Lido’s dominance in staking, validator returns and Ethereum’s overall stability in the face of these profound changes. With so many important upgrades in the horizon with the potential to tremendously improve the Layer-2 scalability scene, we must keep an eye out.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Continuing our coverage of Ethereum, active addresses on the network averaged about 471K per day last week, slightly down from the average of just over half a million at this time last year. But with more activity moving to L2s, active addresses on L1 should remain somewhat flat. Despite a more quiet period of activity in recent weeks, Ethereum continues to boast a strong stablecoin ecosystem that consistently settles billions of dollars per day, as seen in the summary above. About $3B of USDC per day was transferred on Ethereum last week.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Check out the latest issue of Coin Metrics’ State of the Market featuring a new page with novel DeFi Balance Sheet metrics to keep tabs on lending protocol health

Explore the digital assets ecosystem through our entire catalog of original data-driven research.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.