Where in the World is Crypto Trading?

Exploring the Kimchi premium, regional exchange activity, and crypto seasonality.

Get the best data-driven crypto insights and analysis every week:

Where in the World is Crypto Trading?

By: Victor Ramirez

Key Takeaways:

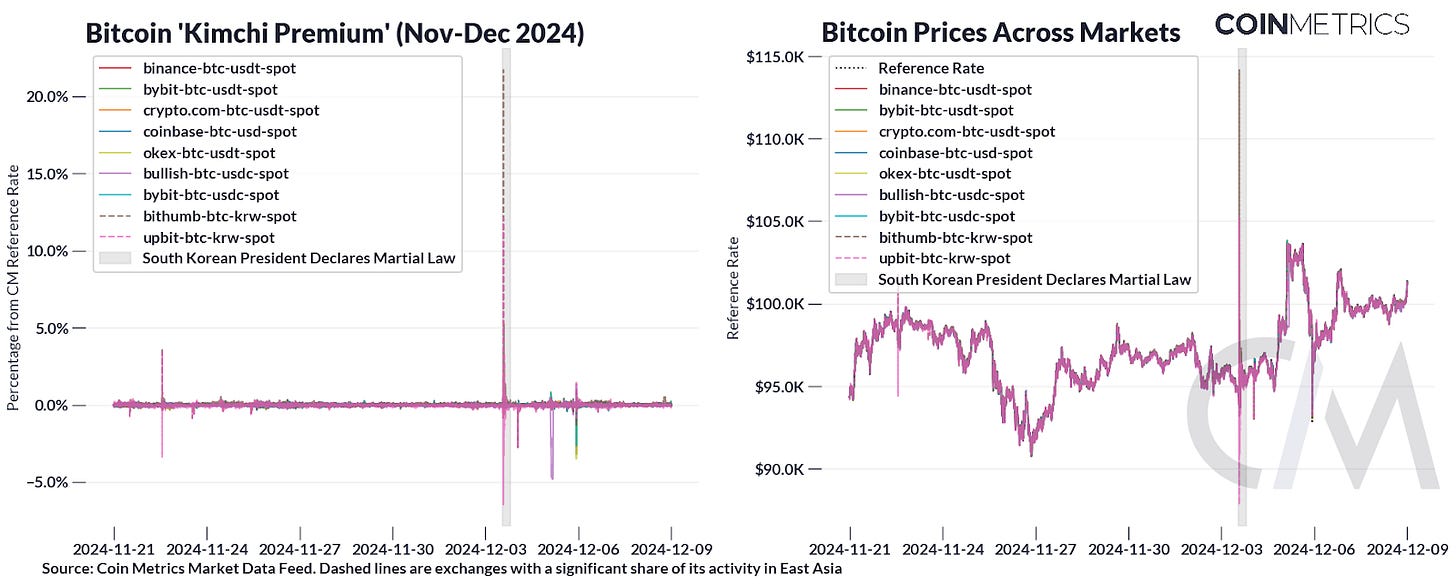

The Kimchi Premium, the colloquial term for the price dislocation between South Korean and global markets, was observed once more during the brief period of political instability in South Korea. As a result, Bitcoin was trading at almost $115k.

Crypto trading sees strong seasonal market and onchain activity across exchanges and assets.

Onchain activity has grown considerably since the beginning of the year, particularly for coins mainly traded in Asia and have been targeted by SEC enforcement actions.

Introduction

Broadly speaking, crypto is touted as a borderless, 24/7/365 market. Although the underlying technology is indeed agnostic to where you are in the world, individual markets are sensitive to seasonal patterns, idiosyncracies across regulatory regimes, and a variety of expressed human preferences around the world.

In this week’s issue of State of the Network, we’ll explore the seasonal and geographical patterns of crypto trading activity. We’ll use the South Korean market as a case-study. Leveraging timezone data, we can observe localized effects across several crypto exchanges and assets. Lastly, we’ll provide an update on on-chain activity to various altcoins.

Capital Controls Give Rise to the Kimchi Premium

One interesting case study for idiosyncratic market behavior happening in a specific region is widely called the Kimchi Premium. The Kimchi Premium is the name given to the discrepancy between the price of digital assets traded in South Korean markets and the global “reference” price. The Kimchi Premium is mainly caused by a high demand for crypto assets in a closed market environment, and the strict regulation that for many years reduced the efficiency of these markets due to the difficulty of international arbitrage.

Although it may present an obvious arbitrage trade, local regulations make it prohibitively difficult for foreigners and institutional investors to capitalize on this. Capital controls on the Korean Won restrict the fiat flows to and from Korean exchanges. By law, only Korean nationals or foreign residents with a resident registration card can make transactions through Korean exchanges. Meanwhile, foreign exchanges face strict controls in South Korea compared to domestic exchanges. For South Koreans to trade crypto on a foreign exchange, one has to first buy from a domestic exchange first to transfer it out to a foreign exchange. These restrictions altogether limit the paths where capital may flow through the system.

Lastly, banking rails make it slow to react to any arbitrage opportunities. Transferring funds from a bank to an exchange can take hours, sometimes up to a day, at which point the arbitrage opportunity will have disappeared.

The Kimchi Premium is well-documented throughout crypto’s history, rising in prominence late 2017.

Source: Coin Metrics Market Data Feed

In the peak of the 2017–2018 bull-run, the Kimchi Premium was persistent. Markets were much more thinly-traded back then, causing a large spread. Notably, FTX’s sister trading firm Alameda Research exploited this regulatory arbitrage starting in 2017 on its way to being one of the largest crypto trading firms at its peak.

Source: Coin Metrics Market Data Feed

In the 2021 bull run, we were once again able to observe the persistence of the Kimchi Premium, albeit to a lesser degree and less-frequent extent. Upbit, a South Korean exchange, saw frequent swings in its Won-Bitcoin markets, culminating in a -12.5% discount in the May 2021 flash crash.

Source: Coin Metrics Market Data Feed

As markets have generally grown more efficiently over time, the Kimchi Premium has mostly closed, though there are some exceptions. The Kimchi Premium even pushed Bitcoin’s quoted above $100k in some South Korean markets, two weeks before global prices had converged to $100k. On December 3rd at 1:27pm UTC, South Korean president Yoon Suk Yeol declared martial law, reviving the premium once more. The premium grew as high as 20% according to Coin Metrics’ 1-minute Reference Rates. At its peak, the premium pushed Bitcoin’s price close to $115k.

Even though the Kimchi Premium is a well-known behavior by now, strict capital controls make it difficult for overseas investors to participate in Korean markets. These result in markets that are prone to liquidity shocks which lead to bouts of price instability.

Crypto Trading Sees Strong Seasonal Behavior

Seasonality in Crypto Exchanges

Although blockchains themselves are permissionless, crypto exchanges remain a necessary intermediary for the vast majority of market participants. And though the crypto market is global, each exchange has to comply with local regulations in order to service users in a country. Given the varying degrees of regulatory overhead around the world, it’s common to see crypto exchanges’ trading activity concentrate towards a few geographic regions. Few, if any exchanges are truly borderless.

We can use this knowledge about legal restrictions by locality, as well as known user preference in a given region and metrics derived from market data to understand how trading activity is distributed around the world. The plot below shows the share of trading activity for a given exchange across different timezones.

Each row is an exchange and each column is its spot trading volume during peak hours for a timezone: 9am–5pm. Each cell value is an exchange’s average volume for a given timezone relative to the average hourly volume. The final column is the average hourly volume per exchange. For example, Binance sees –12.1% less trading volume relative to its average volume of $802M during East Asian hours, but 19.4% greater trading volume during European hours.

Source: Coin Metrics Market Data Feed

As expected, we see South Korean exchanges Bithumb and Upbit and Japanese exchanges Bitbank and Bitflyer trading volume index towards East Asian hours. Upbit is only available in East Asian markets such as South Korea and Singapore. In fact, it’s illegal for anyone in the US to trade on Upbit. Assuming the trading activity from Upbit users physically outside of East Asia is negligible, we can use the trading activity happening outside of the East Asian hours as a baseline for off-peak trading activity.

The overlap in European and American timezones make it difficult to isolate activity for a given region though there are still distinct observable patterns in trading activity. Despite being an American exchange, Kraken has slightly greater activity during EU hours than the US.

In general, we do still see most exchanges overindex towards US trading hours. Coinbase, Gemini, and Crypto.com show the largest bias towards US hours at 36.1%, 57.3%, and 37.1% respectively. Interestingly, Bullish is not legal in the US but exhibits strong (38.6%) preference towards US/Eastern hours.

Seasonality in Asset Trading

Source: Coin Metrics Market Data Feed

We can apply the same method toward asset trading volume across all exchanges. Similar to the exchange breakdown, most asset trading activity still happens on EU/US hours. Bitcoin, ETH, and USDC in particular index toward US hours.

Ripple, Tron, Stellar, and Cardano overindex on East Asian hours relative to other coins. South Koreans have shown an affinity for XRP while Tether on Tron is the dominant stablecoin used in Asia.

Timezone analysis is obviously limited by longitude so we can’t rely on it solely. This is when we’d lean on known user preferences. Bitso’s Crypto Landscape in Latin America, and Stablecoins: The Emerging Market Story have shown Latin Americans have a strong preference for stablecoins, particularly Tether, offering an attractive and stable alternative to inflationary monetary regimes. On the other hand, Tether has been subject to scrutiny from US regulators on its solvency, though it remains compliant and still serves US users. Although we see USDT activity concentrated towards US hours, its volume in this region is likely to come more from South America rather than North America.

We can take this one step further by looking directly onchain to see the transfer value by asset.

Source: Coin Metrics Network Data Pro

The findings from the table above are consistent with what we know from SOTN #165, where we saw distinct bands in onchain activity for several assets. Bitcoin, Ethereum, and USDC’s bias in onchain transfer value towards EU/US hours is consistent with the trading volume.

Tether’s onchain activity deviates slightly from its offchain activity. USDT’s onchain activity peaks considerably during EU hours at +46.4% compared to +17.8% observed offchain on exchanges. In US hours, Tether saw a +15.5% bias when traded in exchanges, but –5.6% when looking at onchain activity.

This is consistent with the regional difference in stablecoin preference we observed in SOTN #220. A similar heatmap broken down by hour can be found on our stablecoin dashboard at stablecoins.coinmetrics.io.

Party Like it’s 2017/21

The ‘dinosaur’ coins of the 2017 and 2021-era have seen substantial price upticks in recent weeks. XRP, TRX, ADA, XLM price has performed considerably well, with the former rising 278% over the past month. But has the increase in price correspond to more onchain activity?

We examined the onchain metrics for these chains and compared them across networks. Different blockchains have different ways of accounting for transaction, so we normalized onchain metrics by using percent growth from the beginning of 2024.

Source: Coin Metrics Network Data Pro

In general, network activity is up for several chains. The Ripple (XRP) ledger has seen the largest increase in activity when measuring transaction counts and active addresses. We also saw increases in transactions for Cardano (ADA) and Tron (TRX). From this, there are some notable similarities between the assets that have seen the sharpest increase in price and on-chain activity:

As we’ve seen above, these tokens have strong regional preference in East Asia relative to Bitcoin and Ethereum.

These tokens were alleged to be securities by the current SEC.

Traders may be bidding for leniency across-the-board by the Trump administration on crypto, with recent SEC appointee Paul Atkins being perceived as ‘friendly’ to crypto. Of course, Gensler was viewed positively by the crypto industry when he was first appointed.

Conclusion

In this issue, we highlighted how the crypto market can behave differently around the world. Local regulations, such as the ones we see in South Korea, strictly control the capital flows in the market, leading to price distortions. Timezone analysis can illuminate how the market expresses a preference for certain trading avenues or assets for a given region. In aggregate, the revealed preferences of market participants around the world comprise the global crypto economy. Understanding the nuances from each market across the world will be helpful in navigating crypto’s continued global adoption.

Network Data Insights

Summary Highlights

Source: Coin Metrics Network Data Pro

Ethena’s USDe supply on Ethereum grew 20% last week, reaching $5.5B and surpassing Dai as the 3rd largest stablecoin. On-chain activity for several ERC-20 and Solana SPL tokens also rose, with increases in daily active addresses and transaction counts.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Be sure to check out our new Ethereum Overview report, diving into ETH’s historical investment performance, adoption, supply dynamics and more.

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

Subscribe and Past Issues

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.