Coin Metrics' State of the Network: Issue 80

Tuesday, December 8th, 2020

Get the best data-driven crypto insights and analysis every week:

Weekly Research Focus

The Bitcoin On-Chain Indicators Primer

By Nate Maddrey and the Coin Metrics Team

We’re excited to introduce our latest in-depth research report: The Bitcoin On-Chain Indicators Primer.

Bitcoin has created a new level of transparency and auditability previously unknown in financial and economic data. Since all Bitcoin transactions are recorded on a public ledger, we can analyze activity in a relatively comprehensive fashion. By creating metrics and analytics using data straight from the Bitcoin blockchain, we can gain novel insights into investors’ behavior that are not possible with traditional, non-crypto assets. There are a variety of different on-chain metrics that we can use to gauge bitcoin market cycles and signal when price is nearing local maximums and minimums.

In a newly released fifteen page report we go over five of bitcoin’s most historically reliable on-chain indicators. Below is an example of one of the five indicators covered in the report: MVRV.

Disclaimer: This report does not constitute investment advice - although these indicators have historically been informative, it does not necessarily mean this will always be the case. Please conduct your own research and view these metrics as one piece in the larger picture.

Market Value to Realized Value (MVRV)

Market value to realized value (MVRV) has historically been one of the most reliable on-chain indicators of bitcoin market tops and bottoms. MVRV is calculated by dividing bitcoin’s market capitalization by its realized capitalization. In our variant of the MVRV calculation, we use free float market capitalization in place of the traditional version of market capitalization which is based on total on-chain supply. To understand MVRV it’s important to first understand three key metrics: market capitalization, free float market capitalization, and realized capitalization.

Market Capitalization

Market capitalization (also often referred to as “market value” or “market cap”) is the most commonly used metric for gauging bitcoin’s total valuation and is often used to rank bitcoin against other cryptoassets. Market cap is derived from traditional finance where it is calculated by multiplying the total number of outstanding shares of a stock by its current market price - in crypto, this corresponds to multiplying an asset’s total supply and market price.

In addition to reflecting bitcoin’s total valuation, market capitalization can be thought of as the valuation of current market participants, and often swings wildly up and down as price and investor sentiment shift.

Free Float Market Capitalization

In the 1990s, traditional markets began to realize the importance of having a “free float” determination to account for the illiquid shares of certain equities. Crypto faces a similar problem, as bitcoin can be permanently lost. Additionally, some units of bitcoin have remained dormant and effectively out of circulation over the long-term, the most famous example being Satoshi’s coins. Therefore market capitalization can grossly misrepresent a cryptoasset's underlying liquidity and capitalization by equally weighting units of supply that are effectively out of circulation.

Because of these deficiencies, we introduced free float supply to more accurately represent the supply of cryptoassets available to the market. Free float supply excludes units of supply that are provably lost or burned, in addition to tokens held by wallets that have been inactive for at least five years.

Free float market capitalization uses free float supply as an input instead of total supply, and is calculated by multiplying free float supply by current market price.

Realized Capitalization

Realized capitalization was introduced in 2018 and gives a more long-term, slow moving measure of bitcoin’s total valuation. Realized capitalization is calculated by valuing each unit of bitcoin individually at the price that it was last transacted on-chain. Therefore it discounts the price of coins that were last moved during periods where price was relatively low.

Realized capitalization can also be thought of as a gross approximation of bitcoin’s aggregate cost basis, also sometimes referred to as its total “stored value.” Theoretically, if each transaction was a trade, realized capitalization would reflect bitcoin’s total cost basis, or in other words the total value stored in bitcoin in terms of U.S. dollars. In reality many bitcoin transactions are not trades, so realized capitalization is not a direct measure of bitcoin’s total stored value. But it still gives an interesting approximation of long-term holders’ sentiment.

Interpreting MVRV

Historically, a high ratio of market capitalization to realized capitalization has signalled that bitcoin price was near a local maximum, while a low ratio has indicated that price is near a local minimum. The few times that MVRV has dropped below one have historically been some of the best times to buy bitcoin. An increasing MVRV indicates that current sentiment is increasing fast relative to stored value, while decreasing MVRV signals the opposite.

More Bitcoin On-Chain Indicators

In addition to MVRV, we analyzed four other on-chain indicators: the spent output profit ratio (SOPR), relative unrealized profit, the market cap to thermocap ratio, and HODL waves. Each indicator gives a different vantage point into bitcoin market cycles.

Read the entire “Bitcoin On-Chain Indicators Primer” here.

Network Data Insights

Summary Metrics

Source: Coin Metrics Network Data Pro

Many Bitcoin (BTC) on-chain metrics went sideways this past week, while others continued to show some encouraging trends. Active addresses, transactions, and transfers were mostly flat week-over-week. Total daily transaction fees, on the other hand, grew by 45.6%, and averaged over $2M a day. This signals that the competition for block space is once again heating up.

In contrast, Ethereum (ETH) fees are dropping after reaching over $5M a day at the end of November. ETH’s mean transaction fee has hovered between $2 and $2.50 over the past week, while BTC’s mean transaction fee has risen above $6.

Network Highlights

Source: Coin Metrics Network Data Charts

Ethereum hash rate hit a new-all-time high on December 1st. ETH hash rate started a steep rise over the summer, spurred on by the rise of DeFi and subsequent rise in ETH transaction fees. However, after DeFi mania cooled off towards the end of September, there were some questions whether ETH’s hash rate would be able to continue its growth.

Furthermore, the launch of the beginning phases of Ethereum 2.0 and the eventual switch to Proof of Stake raises more questions about how Ethereum’s Proof of Work system will perform in the interim. Interestingly, ETH’s hash rate hit a new all-time high the day the ETH 2.0 beacon chain (the first step towards Proof of Stake) went live, and has remained near all-time highs in the days since.

Source: Coin Metrics Network Data Charts

Stablecoins have been back in the news this past week with the contentious introduction of the STABLE Act. Meanwhile, USDC has quietly continued its growth and just hit another milestone: USDC supply passed 3 billion for the first time on December 4th.

Source: Coin Metrics Formula Builder

Although Tether remains the most dominant stablecoin with a total supply of close to 20 billion, USDC has been growing at a faster rate than Tether over the last few months. Used extensively in DeFi and now also used as a method for providing foreign aid, USDC is posed for continued growth in 2021.

Market Data Insights

Bitcoin (BTC) outperformed most other large and mid-cap cryptoassets over the past week. BTC finished the week up 6%, continuing to ride a wave of support from institutional investors. Ethereum (ETH) was not far behind, closing the week up by 5%. Grayscale’s Ethereum Trust has been growing rapidly recently (in addition to its Bitcoin Trust), which is often considered one of the best publicly available gauges of institutional interest.

Source: Coin Metrics Reference Rates

Many of the major mid and small cap assets did not fare as well this past week. Stellar (XLM) dropped 10% on the week, following a large price surge towards the end of November. Tezos (XTZ) and Zcash (ZEC) were also slightly down, dropping 2% and 1% respectively.

Source: Coin Metrics Reference Rates

CM Bletchley Indexes (CMBI) Insights

All CMBI and Bletchley Indexes finished November strongly, returning over 30% for the month. The top performing index was the CMBI 10 Excluding Bitcoin which returned 61.7% for the month, highlighting the strength of the non-Bitcoin large caps during the period. The CMBI Ethereum was the next best performer returning 56.7% for the month, outperforming the CMBI Bitcoin by 15.8%.

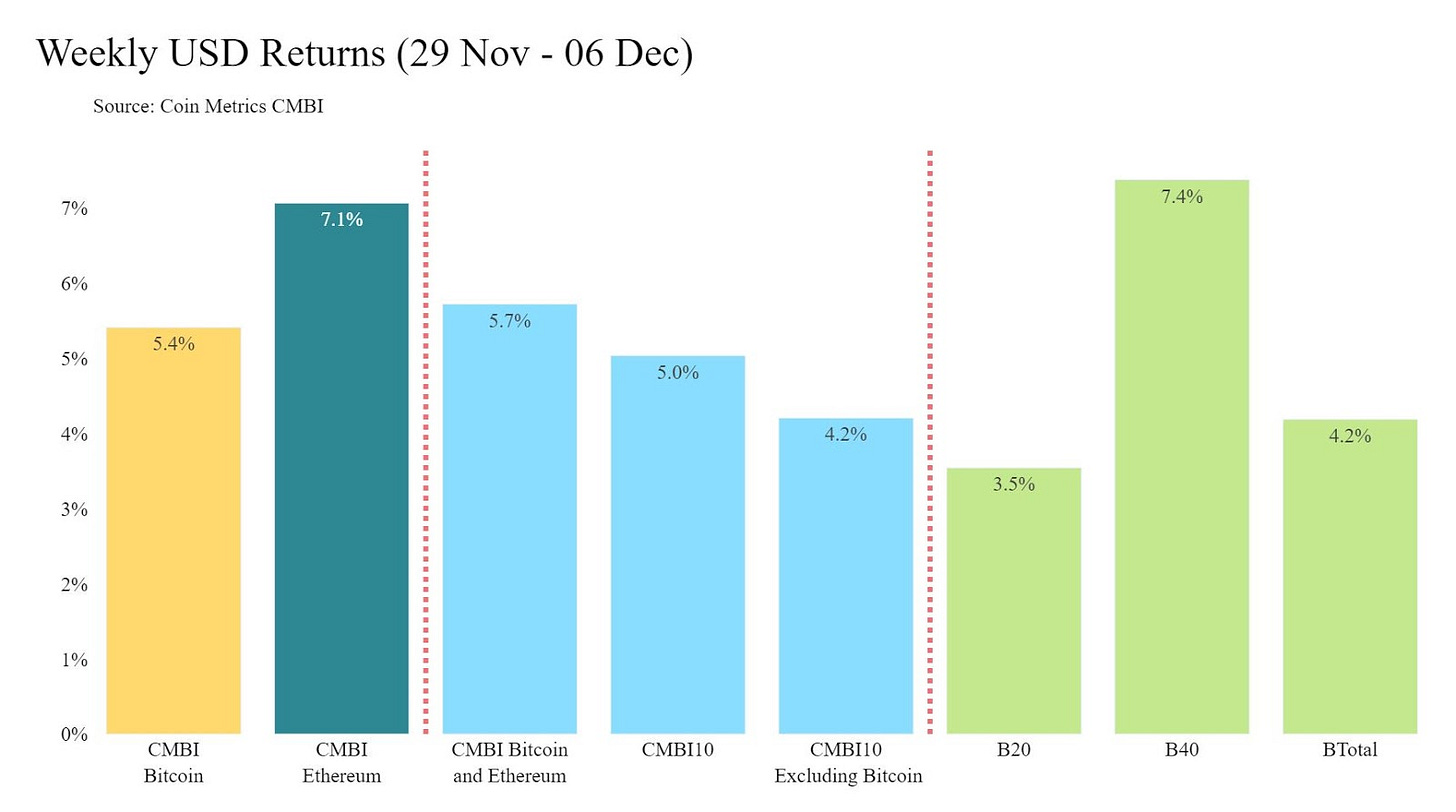

The first week of December was also strong for all indexes, which returned between 3.5% and 7.5%. The Bletchley 40 (small caps) was the best performer, rising 7.4% for the week. The CMBI Ethereum was and CMBI Bitcoin were not too far behind, returning 7.1% and 5.4% for the week respectively.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

View real-time cryptoasset pricing and relevant on-chain data in the new Coin Metrics mobile app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests, don’t hesitate to reach out at info@coinmetrics.io.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.