Coin Metrics' State of the Network: Issue 100

Tuesday, April 27th, 2021

Get the best data-driven crypto insights and analysis every week:

Read our latest in-depth research report here: The Crypto Futures Data Primer.

State of the Network’s 100 Crypto Data Insights

State of the Network just turned 100! In a special edition to celebrate the release of the 100th issue of State of the Network we’ve put together 100 crypto data insights. The insights include a mix of on-chain data and market data, all sourced from our in-house data products.

To see highlights from some of our most popular past issues check out The Best of State of The Network 2020. And to explore some of the data used in this piece and our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps.

$100 invested in Bitcoin (BTC) 100 days ago would be worth $135 today.

$100 invested in Ether (ETH) 100 days ago would be worth $186 today.

$100 invested in Uniswap (UNI) 100 days ago would be worth $401 today.

$100 invested in Dogecoin (DOGE) 100 days ago would be worth $2,742 today.

Source: Coin Metrics Network Data Charts

BTC has averaged 1.12M daily active addresses over the last 100 days.

ETH has averaged 610.74K daily active addresses over the last 100 days.

On April 14th, 2021 BTC daily active addresses reached a new all-time high of 1,366,494.

The all-time high prior to 2021 was 1,290,363 on December 14th, 2017.

Litecoin (LTC) has had more active addresses over the last 100 days (24.39M) than UNI, AAVE, Compound (COMP), MakerDAO (MKR), and Synthetix (SNX) combined (1.41M).

Cardano (ADA) had more active addresses from April 22nd-25th, 2021 (332,151) than the entire month of October 2020 (254,995).

Over its 11 year history there have been over 636M BTC transactions.

Over $4.6T has been settled on the Bitcoin network.

BTC's market cap is about 70% of silver's market cap, and about 9% of gold's (source for non-crypto market caps).

Uniswap's (UNI) market cap ($33.65B) is currently less than half of Coinbase's (COIN) market cap ($77.62B).

UNI, AAVE, COMP, MKR, and SNX's combined market caps ($51.66B) are about 19% of ETH's market cap ($265.99B).

BTC has had an average transaction size of $30.36K over the last 100 days.

ETH has had an average transaction size of $15.66K over the last 100 days.

BTC has had an average transaction fee of $20.68 over the last 100 days.

ETH has had an average transaction fee of $16.68 over the last 100 days.

BTC average transaction fee reached $60.95 on April 20th, its highest ever.

ETH's all-time high mean transaction fee was $38.03 on Feb 23rd, 2021.

Source: Coin Metrics Network Data Charts

Ethereum's average gas price since the start of 2021 has been 147 GWEI.

The average gas price on April 25th was 54 GWEI, the lowest daily average so far in 2021.

Ethereum's all-time high average gas price was 535 GWEI on September 17th, 2020, following the launch of UNI.

Bitcoin has generated over $2B USD worth of transaction fees .

Ethereum has generated over $3.17B USD worth of transaction fees.

Ethereum has generated over $2.3B USD worth of transaction fees since the start of 2021.

Litecoin (LTC), Bitcoin Cash (BCH), Ethereum Classic (ETC), Cardano (ADA), Dogecoin (DOGE), Ripple (XRP), and Bitcoin SV (BSV) have generated a combined total of $13.60M of transaction fees.

Source: Coin Metrics Network Data Charts

BTC's current supply is 18.69M.

ETH's current supply is 115.62M.

DOGE's current supply is 129.21B.

An average of about 13,525.2 new ETH have been issued a day throughout 2021.

An average of about 909.4 new bitcoins have been issued a day throughout 2021.

BTC has had an average annual inflation of 1.78% so far in 2021.

ETH has had an average annual inflation of 4.21% so far in 2021.

According to Coin Metrics’ free float methodology, about 14.57M BTC are considered to be part of free float, liquid supply, which is about 78% of total BTC supply.

About 111.37M ETH is considered free float, 96% of total supply.

About 36.22B XRP is considered free float, 36% of total supply.

One BTC was $7,427 one year ago today.

One ETH was $188 one year ago today.

About 55.2% of BTC has been held for at least a year.

About 22.1% of BTC has been held for at least 5 years.

Source: Coin Metrics Network Data Pro

About 11.2% of BTC has been held for at least 10 years.

BTC's velocity (7-day moving average) has stayed relatively flat since the start of the year, increasing from 4.73 to 4.76.

ETH's velocity (7-day moving average) has increased by about 31% since the start of the year, growing from 9.89 to 13.00.

BTC has had an average of $14.51B of trusted trading volume over the last 100 days.

ETH has had an average of $6.10B of trusted trading volume over the last 100 days.

XRP has had an average of $2.41B of trusted trading volume over the last 100 days.

ADA has had an average of $1.31B of trusted trading volume over the last 100 days.

DOGE has had an average of $2.29B of trusted trading volume over the last 100 days.

BTC's all-time high daily trusted trading volume was $33.58B on February 23rd, 2021.

DOGE had over $40B of trusted trading volume on April 16th, 2021, topping BTC's all-time high.

Source: Coin Metrics Network Data Charts

Over the last 100 days, the average daily BTC inflow to major exchanges (excluding Coinbase) was about $1.41B.

The average daily BTC outflow from major exchanges (excluding Coinbase) over the last 100 days was $1.46B.

There are 9.14M addresses holding at least 0.01 BTC.

There are 816.8K addresses holding at least 1 BTC.

There are 2,242 addresses holding at least 1K BTC.

There are over 14.86M addresses that hold at least 0.01 ETH.

There are over 1.23M addresses that hold at least 1 ETH.

There are 1,308 addresses that hold at least 10K ETH.

The top 1% of BTC addresses (including exchanges) hold about 91% of total supply.

The top 1% of ETH addresses (including exchanges) hold about 97% of total supply.

Addresses holding less than 1 BTC collectively hold about 5% of total BTC supply.

There's currently 156.94K wrapped BTC (WBTC) on Ethereum.

It took about 2.5 years for stablecoin supply to grow from 1B to 10B. It took less than a year to grow from 10B to over 75B.

Source: Coin Metrics Network Data Charts

Total stablecoin supply is on pace to pass 100B before the end of 2021.

The amount of Tether on Ethereum has increased from 13.54B to 24.42B since the start of 2021.

The amount of Tether on Tron has increased from 6.8B to 26B since the start of 2021.

USDC supply has increased from 4.1B to 13.7B since the start of 2021.

DAI supply (ERC-20) has increased from 1.2B to 3.5B since the start of 2021.

There are over 5.48M addresses holding at least $1 worth of stablecoins, up from 1.25M a year ago.

There are over 2.45M addresses holding at least $100 worth of stablecoins, up from 633.95K a year ago.

Source: Coin Metrics Network Data Charts

There are 5,258 addresses holding at least $1M worth of stablecoins, up from 766 a year ago.

4,035 addresses hold at least $1M of Tether, 894 hold at least $1M of USDC, and 219 hold at least $1M of DAI.

Bitcoin miners have earned a total of $26.75B.

Ethereum miners have earned a total of $13.71B.

Bitcoin Cash miners have earned a total of $1.24B.

Ethereum Classic miners have earned a total of $408.16M .

There are 318.50K ERC-20 smart contracts launched on Ethereum.

There are 20.18K ERC-721 smart contracts launched on Ethereum.

There's currently 25.83M ETH held by smart contracts, about 22% of total supply.

An average of 3.96M ETH has been transferred by smart contracts per day over the last 100 days.

BTC hash rate has grown by 20% since the start of 2021.

ETH hash rate has grown by 89% since the start of 2021.

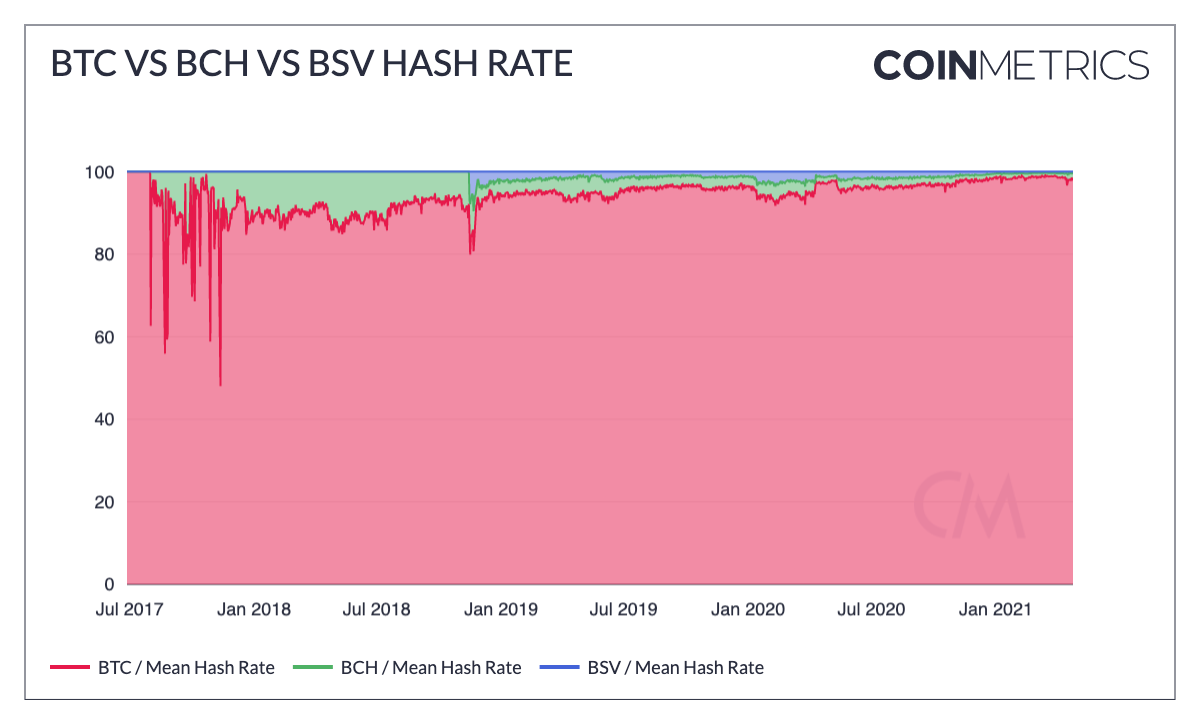

Bitcoin accounts for about 98% of the total combined hash rate generated by miners of Bitcoin, Bitcoin Cash, and Bitcoin SV.

Source: Coin Metrics Network Data Charts

Bitcoin miners collectively hold 4.57M BTC, about 25% of total supply.

About 27.45% of Bitcoin hash rate is contributed by Antminer S9 hardware.

Over the last 100 days, Bitcoin has had an average of 601.77 seconds between new blocks.

Over the same period Ethereum has had an average of 13.30 seconds between new blocks.

BTC perpetual futures open interest hit an all-time high of over $3.8B on Binance in April, 2021.

BTC perpetual futures funding rate has averaged 50.85 APR over the course of 2021.

An all-time high of over $2B worth of BTC longs were liquidated on April 18th, 2021.

An all-time high of over $500M worth of BTC shorts were liquidated on February 8th, 2021.

About 18% of BTC transactions have been sent to exchanges over the last 100 days (excluding Coinbase).

BTC transactions to exchanges peaked at 56% of total transactions on January 4th, 2018.

At least 1.49M BTC is currently held on major centralized exchanges (excluding Coinbase).

The amount of BTC held on centralized exchanges peaked at 1.69M on March 12th, 2020.

Source: Coin Metrics Network Data Charts

Bitcoin market value to realized value ratio (MVRV) has dropped below 1.0 only six times over the last two years.

If you had bought $100 of BTC each of those six days ($600 total investment) it would be worth over $5,600 today.

The last time you could buy 1 BTC for less than $100 was August 18th, 2013.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Check out our new market-data focused newsletter State of the Market, featuring weekly updates on market conditions.

We’re excited to announce the new Coin Metrics mobile app. View real-time cryptoasset pricing and relevant on-chain data in a single app! Download for free here: https://coinmetrics.io/mobile-app/

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.