Coin Metrics' State of the Network: Issue 83

Tuesday, December 29th, 2020

Get the best data-driven crypto insights and analysis every week:

State of the Network Best of 2020

In this special edition we look back at the best issues of State of the Network over the past year. We’ve organized issues into five main themes that we covered throughout 2020:

Bitcoin’s Macro Picture

Valuation and Fundamentals

Exchanges and Trading

Stablecoins and DeFi

Mining and Security

Bitcoin’s Macro Picture

Bitcoin became intertwined with traditional markets this year due to changing macro conditions and a big increase in institutional interest. We covered Bitcoin’s journey over the course of 2020, from the March crypto crash to Q4’s institutional endorsements. Last week, we released our 2020 Year In Review summarizing crypto’s year quarter by quarter:

Source - Issue 42: Data Shows Cryptoasset Selloff was Driven by Short-term Holders

Source - Issue 79: Signs of Institutional Investors

Valuation and Fundamentals

Throughout the year, we analyzed different approaches to valuation and explored crypto fundamentals. In September we introduced Bitcoin: A Novel Economic Institution, a joint research report with ARK Invest that laid out the case for bitcoin as the most compelling monetary asset to emerge since gold. In Issue 80 we released an in-depth research report about using on-chain data to gauge bitcoin market cycles: The Bitcoin On-chain Indicators Primer. We also introduced several new metrics throughout the year, including free float supply:

Source - Issue 80: The Bitcoin On-chain Indicators Primer

Source - Issue 57: Introducing Free Float Supply

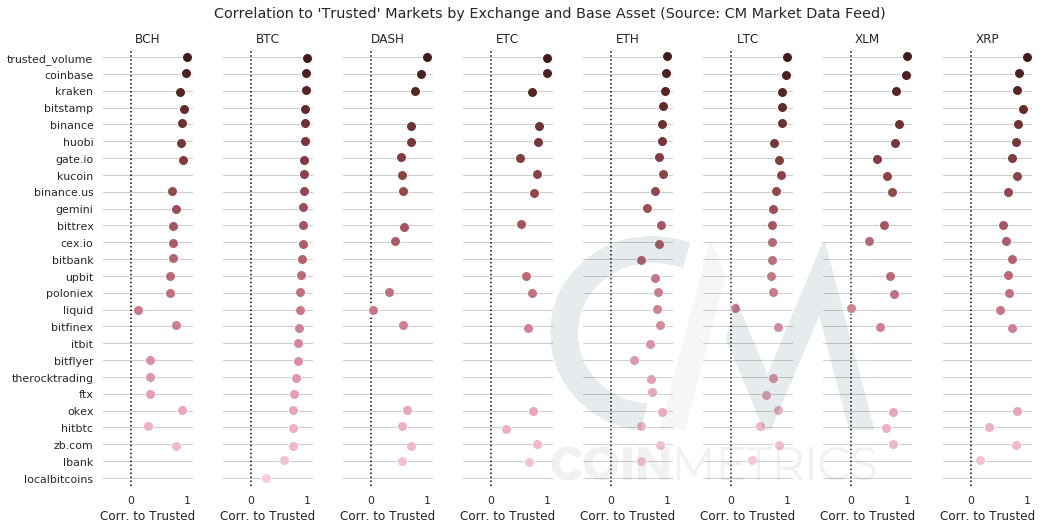

Exchanges and Trading

Another focus was crypto’s market structure, including exchanges and trading activity. We analyzed trading volume and introduced our “Trusted Trading Volume” framework to help identify legitimate trading volume. We analyzed the derivatives market including a high level look at perpetual swaps. And we covered exchange lawsuits and mishaps like the fallout after the arrest of the BitMEX leadership team:

Source - Issue 61: Introducing Coin Metrics' Trusted Volume Framework

Source - Issue 72: Analyzing the Fallout From the BitMEX Lawsuits

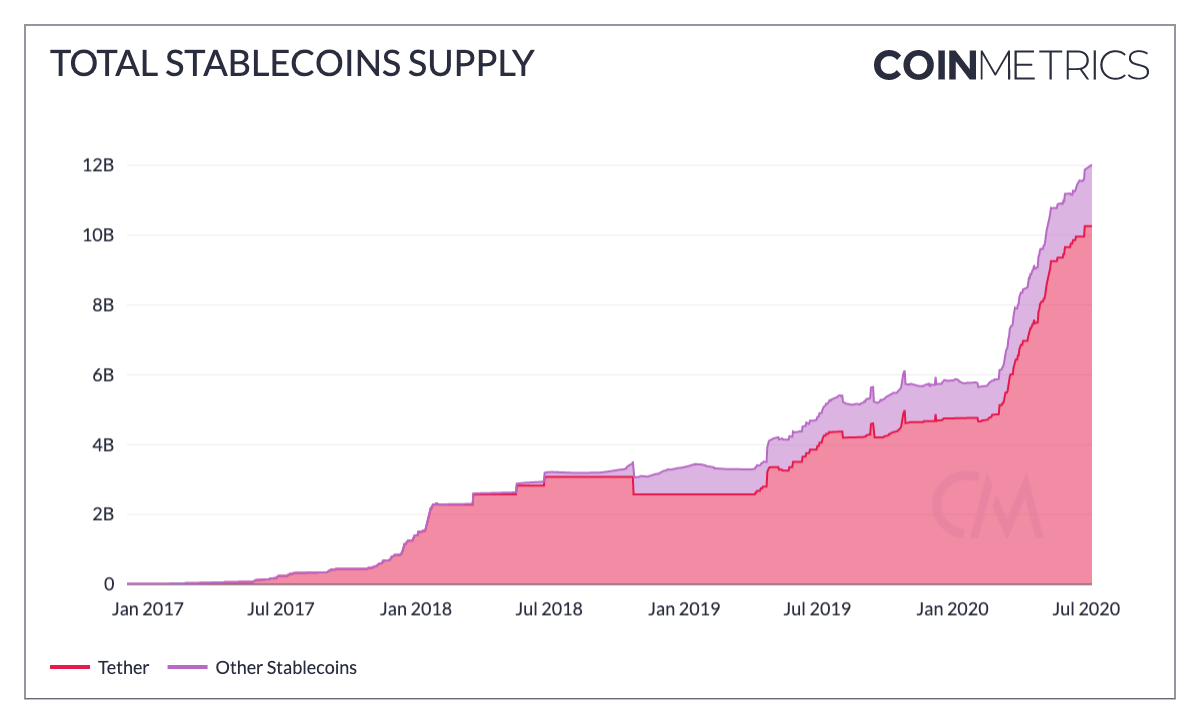

Stablecoins and DeFi

In Issue 59 we introduced an in-depth research report on the rapid Rise of Stablecoins. We continued to write about stablecoins throughout the year and analyzed their supply distribution and on-chain activity. We also covered the rise of DeFi, including a look at the state of DeFi tokens:

Issue 50: Stablecoin Heatmaps Show Tether is Mostly Used During Asian and European Market Hours

Issue 54: Analyzing Stablecoin Supply and Activity Distribution

Issue 64: The DeFi Fee Explosion: How YAM’s Collapse Drove Ethereum Fees to New Heights

Source - Issue 59: The Rise of Stablecoins

Source - Issue 77: The State of DeFi Tokens

Mining and Security

We also wrote extensively about Bitcoin mining and security. We took a macro look at miner economics and did a deep dive into the data on hash rate distribution. We also introduced several new metrics including a suite of metrics on miner flows and on-chain activity:

Issue 44: Understanding Miner Econonomics from First Principles

Issue 49: Introducing The CMBI Bitcoin Hash Rate Index and Observed Work

Issue 75: Following Flows: A Look at Miners’ On-Chain Payments

Source - Issue 45: The Signal and the Nonce Redux: From S9s to S17s

Source - Issue 68: Measuring Bitcoin's Decentralization

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

Check out the Coin Metrics Blog for more in depth research and analysis.